UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

AVALON GLOBOCARE CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | No fee required. | |||

| ☒ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

|

Common shares, $1.00 par value per share, of Lonlon Biotech Ltd. | ||||

| (2) | Aggregate number of securities to which transaction applies: | |||

|

10,001 shares, $1.00 par value, Lonlon Biotech Ltd. | ||||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): $0.33 per share, calculated in accordance with Rule 0-11(c)(1)(i) based on the value of the shares of Lonlon Biotech Ltd. being acquired by the registrant, who is the acquiring person, established in accordance with Rule 0-11(a)(4) for securities of issuers with an accumulated capital deficit based on one-third of the par value of such shares, or $3,333.67 in the aggregate. In accordance with Section 14(g) of the Securities Exchange Act of 1934, as amended, the filing fee was determined by multiplying the aggregate value calculated in the preceding sentence by $0.0001091. | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

|

$3,333.67 | ||||

| (5) | Total fee paid: | |||

|

$0.37 | ||||

| ☐ | Fee paid previously with preliminary materials: | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

DATED JULY 15, 2021

AVALON GLOBOCARE CORP.

4400 Route 9 South, Suite 3100

Freehold, New Jersey 07728

[_], 2021

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Avalon GloboCare Corp., a Delaware corporation (“Avalon” or the “Company”), which will be held at [_] on [_], 2021, beginning at [_], local time (the “annual meeting”), for the purposes detailed below, including (i) the election of our directors as described herein, (ii) the ratification of the appointment of Marcum LLP as the Company’s independent auditors for the fiscal year ending December 31, 2021 as described herein and (iii) the approval of the issuance of the shares of common stock, par value US$0.0001 per share, of Avalon (the “Avalon Common Stock”) to be issued in connection with the proposed acquisition of Lonlon Biotech Ltd., a company incorporated in the British Virgin Islands (“BVI”) (“Sen Lang”) by Avalon and the related facilitating transactions, including the Equity Financing (as defined below), pursuant to the rules of the Nasdaq Stock Market (“Nasdaq”) as described herein.

As previously announced, on June 13, 2021, Avalon entered into a Share Purchase Agreement (the “Purchase Agreement”), by and among the Company, Sen Lang, the holders of the share capital of Sen Lang (the “Sen Lang Shareholders”), the ultimate beneficial owners of the Sen Lang Shareholders (the “Sen Lang Beneficial Shareholders” and, together with the Sen Lang Shareholders, the “Sen Lang Owners”) and a representative of the Sen Lang Owners (the “Sen Lang Representative”). Pursuant to the Purchase Agreement, subject to the satisfaction of the conditions to closing therein, including approval by the Avalon stockholders pursuant to the rules of Nasdaq, Avalon agreed to purchase (the “Acquisition”) all of the issued and outstanding share capital of Sen Lang (the “Sen Lang Shares”). A copy of the Purchase Agreement is attached as Annex A to the accompanying proxy statement, and you are encouraged to read it in its entirety.

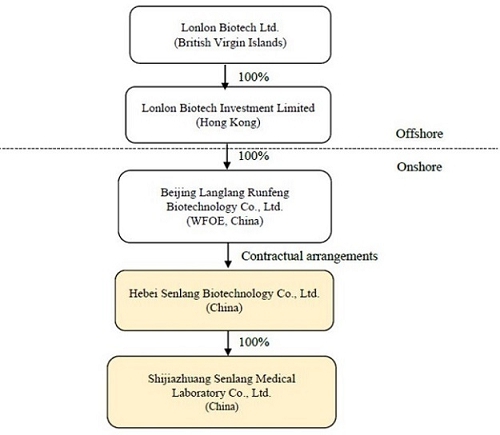

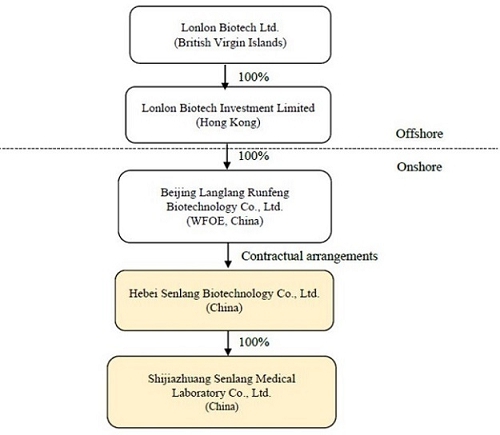

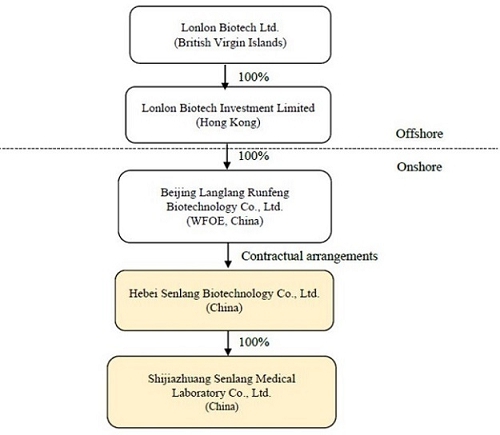

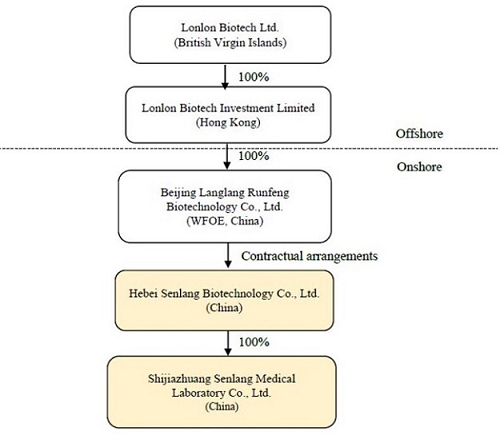

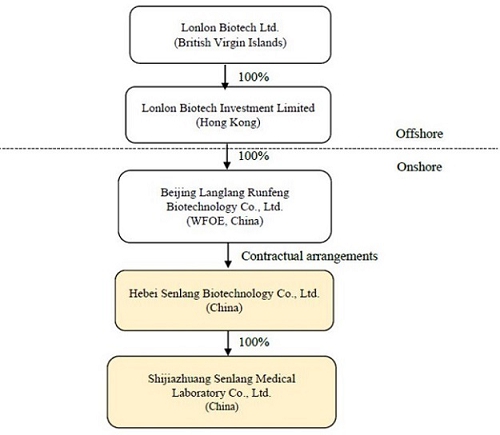

Sen Lang, through a “variable interest entity” (“VIE”) structure (described in more detail in the section of the accompanying proxy statement titled “The Acquisition—The VIE Structure”) of contractual rights held by its wholly-owned subsidiary Beijing Langlang Runfeng Biotechnology Co., Ltd., a wholly foreign owned enterprise with limited liability organized and existing under the laws of the People’s Republic of China (the “PRC”) (the “PRC Subsidiary”), has full economic benefit and management control over, and is consolidated for accounting purposes with, Senlang Biotechnology Co. Ltd., a PRC domestic company with limited liability organized and existing under the laws of the PRC (the “OpCo” or “SenlangBio”). SenlangBio is mainly engaged in the business of research and development in relation to CAR-T cell therapy, immune cell therapy and related drug development. SenlangBio is owned 100% by certain of the Sen Lang Beneficial Shareholders. A wholly-owned subsidiary of SenlangBio, Shijiazhuang Senlang Medical Laboratory Co., Ltd., a company with limited liability organized and existing under the laws of the PRC (“SenlangBio Clinical Laboratory”) is engaged in the business of testing of immunology, serology and molecular genetics specialties for patients, including hematology-tumor diagnostics and testing prior to clinical trials for cell therapy.

Prior to the execution of the Purchase Agreement, the Board of Directors of Avalon (the “Board”), unanimously (i) determined that the terms and provisions of the Purchase Agreement and the transactions contemplated thereby, including the Acquisition, are fair to, advisable and in the best interests of the Company and its stockholders, (ii) approved the Purchase Agreement and the transactions contemplated thereby, including the Acquisition and the issuance of the Acquisition Shares (as defined below), (iii) authorized, empowered and directed the Company to perform all of its obligations under the Purchase Agreement and the Exchange Agreement (as defined below) and related documents, and (iv) resolved to recommend the approval by the stockholders of the Company of the issuance of the Acquisition Shares in connection with the Acquisition and the issuance of the Exchange Shares (as defined below) in connection with the Exchange Agreement in compliance with the rules of Nasdaq (the “Company Board Recommendation”). Accordingly, the board recommends a vote “FOR” the proposal to approve the issuance of the Acquisition Shares in connection with the Acquisition and the issuance of the Exchange Shares in connection with the Exchange Agreement in compliance with the rules of Nasdaq and “FOR” each of the other proposals to be voted on at the annual meeting.

The purchase price being paid by Avalon to the Sen Lang Shareholders under the Purchase Agreement for the Sen Lang Shares is an aggregate of 81 million shares (the “Acquisition Shares”) of Avalon Common Stock. Ten percent (10%), or 8.1 million, of such shares will be held in escrow for 12 months following the closing to satisfy any indemnification obligations of the Sen Lang Shareholders under the Share Purchase Agreement. In addition, at the closing of the Acquisition, it is expected that Dr. Jianqiang Li, scientific founder and CSO of SenlangBio, will join the board of the Company, and Dr. Li will also be appointed as Chief Technology Officer of the Company. The Acquisition Shares will not be registered under the Securities Act of 1933, as amended (the “Securities Act”) and, therefore, will be restricted securities under Rule 144 under the Securities Act for six months or longer after the closing of the Acquisition, subject to “affiliate” status with the Company under the Securities Act.

In connection with the Acquisition, on June 13, 2021, an institutional investor (the “Investor”) entered into an agreement, as amended on June 24, 2021, with SenlangBio related to the purchase of registered capital of SenlangBio (the “OpCo Capital Increase Agreement”) pursuant to which the Investor will acquire an aggregate of up to 13.5% of the equity ownership of SenlangBio for an aggregate purchase price (the “Subscription Amount) of approximately US$30,000,000 (represented by an actual investment of RMB200,000,000) (the “Equity Financing”), which funds will be invested in SenlangBio in three equal installments of approximately US$10,000,000, at a fixed price, the first to be upon the closing of the Acquisition, the second to be within three months after the closing and the third to be within six months after the closing. In addition, pursuant to a Securities Exchange Agreement, as amended on June 24, 2021 (the “Exchange Agreement”), by and among the Company, Sen Lang, SenlangBio and the Investor, dated June 13, 2021, the Investor shall have the right, exercisable between the six-month and five year-anniversaries of the respective initial closing and installment closings, to elect to exchange, from time to time, all or part of its then-owned equity ownership of SenlangBio for shares (the “Exchange Shares”) of Avalon Common Stock at a fixed exchange price of US$1.21 per share of Avalon Common Stock, which was the market price of the Avalon Common Stock as of the date of the Exchange Agreement under Nasdaq rules. In addition, the Exchange Agreement provides that the Investor may only exchange up to 10% of its total investment amount in any 30 day period.

The proxy statement attached to this letter and the enclosed Annual Report of Avalon to stockholders for the fiscal year ended December 31, 2020, which includes the information required by Rule 14a-3 of the Securities Exchange Act of 1934, provides you with information about the proposed Acquisition and the annual meeting. I encourage you to read the entire proxy statement and accompanying Annual Report carefully.

At the Avalon annual meeting of stockholders, Avalon will ask its stockholders to, among other things, elect the nine director nominees named in the proxy statement to hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified, ratify the appointment of Marcum LLP as the Company’s independent auditors for the fiscal year ending December 31, 2021 and approve the issuance of the Acquisition Shares in connection with the Acquisition and the issuance of the Exchange Shares in connection with the Exchange Agreement in compliance with the rules of Nasdaq, each as described in the proxy statement.

Only stockholders of record at the close of business on [_], 2021, the record date for determining the stockholders entitled to notice of and to vote at the annual meeting, are entitled to notice of and to vote at the annual meeting and any adjournment thereof.

Your vote is very important. The Acquisition cannot be completed unless the issuances of the Acquisition Shares and the Exchange Shares are adopted by the affirmative vote of the holders of a majority of votes cast by the stockholders present in person or represented by proxy and entitled to vote thereon at the annual meeting.

Whether or not you are able to attend the annual meeting in person, please complete, sign and date the enclosed proxy card and return it in the envelope provided as soon as possible, or follow the instructions provided for submitting a proxy by telephone or the Internet. If you hold shares through a broker or other nominee, you should follow the procedures provided by your broker or other nominee. These actions will not limit your right to vote in person if you wish to attend the annual meeting and vote in person.

Thank you for your cooperation and your continued support of Avalon.

| Sincerely, | |

| Wenzhao “Daniel” Lu, | |

| Chairman of the Board of Directors |

This proxy statement is dated [_], 2021 and

is first being mailed along with the Annual Report to stockholders

on or about [_], 2021.

AVALON GLOBOCARE CORP.

4400 Route 9 South, Suite 3100

Freehold, New Jersey 07728

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON [ ], 2021

To the Stockholders of Avalon GloboCare Corp.:

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders (the “annual meeting”) of Avalon GloboCare Corp., a Delaware corporation (the “Company,” “Avalon,” “we,” “our” or “us”), will be held on [ ], 2021, at [ ] [a/p.m.], Eastern time at [ ]. Only stockholders who hold shares of Avalon common stock, $0.0001 par value per share (“Avalon Common Stock”) at the close of business on [ ], 2021, the record date for the annual meeting, are entitled to vote at the annual meeting and any adjournments or postponements thereof.

The annual meeting is being held for the following purposes:

| 1. | The “Director Election Proposal”—to elect the nine director nominees named in the proxy statement to hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified; |

| 2. | The “Auditor Proposal”—to ratify the appointment of Marcum LLP as the Company’s independent auditors for the fiscal year ending December 31, 2021; and |

| 3. | The “Nasdaq Proposal”—to approve, pursuant to the rules of the Nasdaq Stock Market as described herein, the issuance of (i) 81 million shares (the “Acquisition Shares”) of the common stock, par value US$0.0001 per share, of Avalon (the “Avalon Common Stock”) issuable to the holders (the “Sen Lang Shareholders”) of the share capital of Lonlon Biotech Ltd., a company incorporated in the British Virgin Islands (“BVI”) (“Sen Lang”), pursuant to the terms of the Share Purchase Agreement, dated as of June 13, 2021 (as may be amended from time to time, the “Purchase Agreement”), by and among Avalon, Sen Lang, the ultimate beneficial owners of the Sen Lang Shareholders (the “Sen Lang Beneficial Shareholders” and, together with the Sen Lang Shareholders, the “Sen Lang Owners”) and a representative of the Sen Lang Owners (the “Sen Lang Representative”), pursuant to which Avalon will acquire (the “Acquisition”) all of the issued and outstanding share capital of Sen Lang (the “Sen Lang Shares”) and (ii) shares of Avalon Common Stock (the “Exchange Shares”) issuable upon the exchange of shares of Senlang Biotechnology Co. Ltd., a PRC domestic company with limited liability organized and existing under the laws of the PRC (the “OpCo” or “SenlangBio”) to be issued to an investor in a private placement of the equity of SenlangBio (all as described in more detail herein); | |

| 4. | The “Adjournment Proposal”—to approve the adjournment of the annual meeting to a later date or time, if necessary, to solicit additional proxies if, based upon the tabulated vote at the time of the annual meeting, there are not sufficient votes to approve the Nasdaq Proposal. |

After careful consideration, Avalon’s board of directors has unanimously determined that the forms, terms and provisions of the Purchase Agreement and the Exchange Agreement, including the Acquisition and the Equity Financing, are advisable and in the best interests of Avalon and its stockholders, and unanimously recommends you vote “FOR” Proposals 1 through 3, as well as the Adjournment Proposal.

Avalon will transact no other business at the annual meeting, except such business as may properly be brought before the annual meeting or any adjournment or postponement thereof. Please refer to the proxy statement of which this notice is a part for further information with respect to the business to be transacted at the annual meeting.

The approval of the Auditor Proposal, the Nasdaq Proposal, and the Adjournment Proposal requires the affirmative vote of the holders of a majority of votes cast by the stockholders present in person or represented by proxy and entitled to vote thereon at the annual meeting. The approval of the Director Election Proposal requires the affirmative vote of a plurality of the votes properly cast on the election of directors.

Completion of the Acquisition is conditioned upon, among other things, approval of the Nasdaq Proposal.

Your attention is directed to the proxy statement and Annual Report of Avalon to stockholders for the fiscal year ended December 31, 2020, which includes the information required by Rule 14a-3 of the Securities Exchange Act of 1934, accompanying this notice (including the financial statements and annexes attached thereto) for a more complete description of the proposed Acquisition and related transactions and each of our proposals. We encourage you to read this proxy statement and Annual Report carefully in its entirety. In particular, we urge you to read carefully the sections entitled “Risk Factors” beginning on page 18 of the accompanying proxy statement and in the Annual Report. If you have any questions or need assistance voting your shares, please call Avalon at 732-780-4400.

Your vote is very important, regardless of the number of shares of Avalon Common Stock that you own. Even if you plan to attend the annual meeting, we request that you complete, sign, date and return the enclosed proxy card in the envelope provided, or submit your proxy by telephone or the Internet prior to the annual meeting, and thus ensure that your shares will be represented and voted at the annual meeting if you later become unable to attend. If your shares are held in a stock brokerage account or by a bank or other nominee, please follow the instructions that you receive from your broker, bank or other nominee to vote your shares.

| By Order of the Board of Directors, | |

| /s/ Wenzhao “Daniel” Lu | |

| Wenzhao “Daniel” Lu | |

| [ ], 2021 | Chairman of the Board of Directors |

TABLE OF CONTENTS

i

ii

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND THE ACQUISITION

The following questions and answers briefly address some commonly asked questions regarding the proposed Acquisition and about the proposals to be presented at the Avalon annual meeting of stockholders, including with respect to the proposed Acquisition. The following questions and answers may not include all the information that is important to Avalon stockholders. Stockholders are urged to read carefully this entire proxy statement, including the financial statements and annexes attached hereto and the other documents referred to herein. Except where indicated, the information in this proxy statement does not give effect to the closing of the Equity Financing described in Proposal No. 3 of this proxy statement. References in this proxy statement to “$” refer to U.S. dollars.

| Q: | Why am I receiving this proxy statement? |

| A: | Avalon has furnished these materials to you by mail, in connection with the Company’s solicitation of proxies for use at the Annual Meeting of Stockholders to be held on [ ], 2021, at [ : ] [ ].m. Eastern Time. This year’s annual meeting of shareholders will be held as a virtual meeting. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend and participate in the annual meeting online via a live webcast by visiting [ ]. These materials have also been made available to you on the Internet. These materials describe the proposals on which the Company would like you to vote and also give you information on these proposals so that you can make an informed decision. We are furnishing our proxy materials on or about [ ], 2021 to all stockholders of record entitled to vote at the annual meeting. |

In addition, on June 13, 2021, Avalon GloboCare Corp., a Delaware corporation (the “Company” or “Avalon”), entered into a Share Purchase Agreement (the “Purchase Agreement”), by and among the Company, Lonlon Biotech Ltd., a company incorporated in the British Virgin Islands (“BVI”) (“Sen Lang”), the holders of the share capital of Sen Lang (the “Sen Lang Shareholders”), the ultimate beneficial owners of the Sen Lang Shareholders (the “Sen Lang Beneficial Shareholders” and, together with the Sen Lang Shareholders, the “Sen Lang Owners”) and a representative of the Sen Lang Owners (the “Sen Lang Representative”). Pursuant to the Purchase Agreement, subject to the satisfaction of the conditions to closing therein, including approval by the Avalon stockholders pursuant to the rules of the Nasdaq Stock Market (“Nasdaq”), Avalon agreed to purchase (the “Acquisition”) all of the issued and outstanding share capital of Sen Lang (the “Sen Lang Shares”).

Sen Lang, through a “variable interest entity” structure (described in more detail below under “VIE Structure”) of contractual rights held by its wholly-owned subsidiary Beijing Langlang Runfeng Biotechnology Co., Ltd., a wholly foreign owned enterprise with limited liability organized and existing under the laws of the People’s Republic of China (the “PRC”) (the “PRC Subsidiary”), has full economic benefit and management control over, and is consolidated for accounting purposes with, Senlang Biotechnology Co. Ltd., a PRC domestic company with limited liability organized and existing under the laws of the PRC (the “OpCo” or “SenlangBio”). SenlangBio is mainly engaged in the business of research and development in relation to CAR-T cell therapy, immune cell therapy and related drug development. SenlangBio is owned 100% by certain of the Sen Lang Beneficial Shareholders. A wholly-owned subsidiary of SenlangBio, Shijiazhuang Senlang Medical Laboratory Co., Ltd., a company with limited liability organized and existing under the laws of the PRC (“SenlangBio Clinical Laboratory”) is engaged in the business of testing of immunology, serology and molecular genetics specialties for patients, including hematology-tumor diagnostics and testing prior to clinical trials for cell therapy. For a more detailed discussion of the business of SenlangBio and SenlangBio Clinical Laboratory, please see the section entitled “Information about SenlangBio.”

Prior to the execution of the Purchase Agreement, the Board of Directors of Avalon (the “Board”), unanimously (i) determined that the terms and provisions of the Purchase Agreement and the transactions contemplated thereby, including the Acquisition, are fair to, advisable and in the best interests of the Company and its stockholders, (ii) approved the Purchase Agreement and the transactions contemplated thereby, including the Acquisition and the issuance of the Acquisition Shares (as defined below), (iii) authorized, empowered and directed the Company to perform all of its obligations under the Purchase Agreement and the Exchange Agreement (as defined below) and related documents, and (iv) resolved to recommend the approval by the stockholders of the Company of the issuance of the Acquisition Shares in connection with the Acquisition and the issuance of the Exchange Shares (as defined below) in connection with the Exchange Agreement in compliance with the rules of Nasdaq (the “Company Board Recommendation”).

1

The purchase price being paid by Avalon to the Sen Lang Shareholders under the Purchase Agreement for the Sen Lang Shares is an aggregate of 81 million shares (the “Acquisition Shares”) of the common stock, par value US$0.0001 per share, of Avalon (the “Avalon Common Stock”). Ten percent (10%), or 8.1 million, of such shares will be held in escrow for 12 months following the closing to satisfy any indemnification obligations of the Sen Lang Shareholders under the Share Purchase Agreement. In addition, at the closing of the Acquisition, it is expected that Dr. Jianqiang Li, scientific founder and CSO of SenlangBio, will join the board of the Company, and Dr. Li will also be appointed as Chief Technology Officer of the Company. The Acquisition Shares will not be registered under the Securities Act of 1933, as amended (the “Securities Act”) and, therefore, will be restricted securities under Rule 144 under the Securities Act for six months or longer after the closing of the Acquisition, subject to “affiliate” status with the Company under the Securities Act.

A copy of the Purchase Agreement is attached to this proxy statement as Annex A. For a more detailed discussion of the Purchase Agreement, please see the section entitled “The Purchase Agreement.”

In connection with the Acquisition, on June 13, 2021, an institutional investor (the “Investor”) entered into an agreement, as amended on June 24, 2021, with SenlangBio related to the purchase of registered capital of SenlangBio (the “OpCo Capital Increase Agreement”) pursuant to which the Investor will acquire an aggregate of up to 13.5% of the equity ownership of SenlangBio for an aggregate purchase price (the “Subscription Amount) of approximately US$30,000,000 (represented by an actual investment of RMB200,000,000) (the “Equity Financing”), which funds will be invested in SenlangBio in three equal installments of approximately US$10,000,000, at a fixed price, the first to be upon the closing of the Acquisition, the second to be within three months after the closing and the third to be within six months after the closing. In addition, pursuant to a Securities Exchange Agreement, as amended on June 24, 2021 (the “Exchange Agreement”), by and among the Company, Sen Lang, SenlangBio and the Investor, dated June 13, 2021, the Investor shall have the right, exercisable between the six-month and five year-anniversaries of the respective initial closing and installment closings, to elect to exchange, from time to time, all or part of its then-owned equity ownership of SenlangBio for shares (the “Exchange Shares”) of Avalon Common Stock at a fixed exchange price of US$1.21 per share of Avalon Common Stock, which was the market price of the Avalon Common Stock as of the date of the Exchange Agreement under Nasdaq rules. In addition, the Exchange Agreement provides that the Investor may only exchange up to 10% of its total investment amount in any 30 day period.

This proxy statement and its annexes contain important information about the proposed Acquisition and Equity Financing and the proposals to be acted upon at the annual meeting. You should read this proxy statement and its annexes and the Annual Report, which is incorporated in its entirety into this proxy statement by reference, carefully and in their entirety.

Q: What is included in these materials?

A: These materials include:

| ● | this Proxy Statement for the annual meeting; and |

| ● | the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (the “Annual Report”). |

Q: What is the proxy card?

A: The proxy card enables you to appoint David Jin, our Chief Executive Officer, and Luisa Ingargiola, our Chief Financial Officer, as your representatives at the annual meeting. By completing and returning a proxy card, you are authorizing these individuals to vote your shares at the annual meeting in accordance with your instructions on the proxy card. This way, your shares will be voted whether or not you attend the annual meeting.

2

| Q: | What matters will stockholders consider at the Avalon annual meeting? |

| A: | At the Avalon annual meeting of stockholders, Avalon will ask its stockholders to vote in favor of the following proposals (the “Avalon Proposals”): |

| ● | Proposal 1—to elect the nine director nominees named in the proxy statement to hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified (the “Director Election Proposal”); |

| ● | Proposal 2—to ratify the appointment of Marcum LLP as the Company’s independent auditors for the fiscal year ending December 31, 2021 (the “Auditor Proposal”); and |

| ● | Proposal 3—to approve, pursuant to the rules of the Nasdaq Stock Market, the issuance of (i) the Acquisition Shares pursuant to the terms of the Purchase Agreement and (ii) the Exchange Shares (the “Nasdaq Proposal”); |

| ● | Proposal 4—to adjourn the annual meeting, if necessary, to another time or place to solicit additional proxies if there are not sufficient votes in favor of Proposal 1 (the “Adjournment Proposal”). |

| Q: | What will happen upon the consummation of the Acquisition and the Equity Financing? |

| A: | On the date of closing of the Acquisition (the “Closing Date”), Avalon will issue the Acquisition Shares to the Sen Lang Shareholders in exchange for all of the outstanding equity of Sen Lang, and will thereby acquire the full economic benefit and management control over, and consolidate for accounting purposes with, SenlangBio. In addition, the Equity Financing will be consummated, whereby the Investor will begin to acquire up to approximately 13.5% of the equity ownership of SenlangBio for an aggregate purchase price of approximately US$30 million (represented by an actual investment of RMB200,000,000), which funds will be invested in SenlangBio in three equal installments of approximately US$10,000,000, at a fixed price, the first to be on the Closing Date, the second to be within three months after the closing and the third to be within six months after the closing. |

| Q: | Why is Avalon proposing to effect the Acquisition? |

| A: | Avalon believes that the post-Acquisition company will have several potential advantages, including: (i) a diverse pipeline of cell therapy product candidates, (ii) expanded footprint in China, (iii) operational synergies and (iv) an experienced management team. |

For a more complete discussion of Avalon’s reasons for the Acquisition, please see the sections entitled “The Acquisition—Reasons for the Acquisition.”

| Q: | What equity stake will current Avalon stockholders and the Sen Lang Shareholders have in Avalon after the closing of the Acquisition and prior to the consummation of the Equity Financing? |

| A: | It is anticipated that, upon the consummation of the Acquisition, the ownership of Avalon will be as follows: |

| ● | Current Avalon stockholders will own 51.0% of the total voting shares outstanding; and |

| ● | Current Sen Lang Shareholders will own 49.0% of the total voting shares outstanding. |

The numbers of shares and percentage interests set forth above do not take into account (i) shares of Avalon Common Stock issuable upon the exchange of shares of SenlangBio purchased by the Investor in the Equity Financing, pursuant to the Exchange Agreement, (ii) shares of Avalon Common Stock issuable upon the exercise of outstanding options and warrants and (iii) potential future issuances of Avalon securities.

In addition, under the Exchange Agreement, the Investor shall have the right, exercisable between the six-month and five year-anniversaries of the respective initial closing and installment closings, to elect to exchange, from time to time, all or part of its equity ownership of SenlangBio for Exchange Shares of Avalon at an effective exchange price of $1.21 per share of Avalon Common Stock. Following the completion of the financing and assuming the full funding by the investor in the financing, the aggregate number of shares of Avalon Common Stock that would be issuable under the Exchange Agreement (assuming the exchange of all shares) would be approximately 25,885,000 (using the conversion rate of US dollars to RMB of 6.3856 as of June 11, 2021). The resultant equity ownership of Avalon would be as follows:

| ● | Current Avalon stockholders will own 44.1% of the total voting shares outstanding; |

| ● | Current Sen Lang Shareholders will own 42.4% of the total voting shares outstanding and |

| ● | The Investor will own 13.5% of the total voting shares outstanding. |

3

| Q: | Who will be the officers and directors of the post-Acquisition company if the Acquisition is consummated? |

| A: | It is currently expected that Dr. Jianqiang Li, scientific founder and CSO of SenlangBio, will join the board of Avalon, and Dr. Li will also be appointed as Chief Technology Officer of Avalon. Meng Li, Avalon’s Chief Operating Officer and a director, will resign from her position on the board of Avalon. The Avalon board and management will otherwise remain the same aside from Dr. Li, with Wenzhao Lu (Chairman), David Jin, MD, PhD, Steven A. Sanders, Yancen Lu, Wilbert J. Tauzin II, Willliam B. Stilley, III, Tevi Troy and Yue “Charles” Li continuing to serve on the board and Dr. Jin continuing to serve as President and Chief Executive Officer, Ms. Li as Chief Operating Officer and Luisa Ingargiola as Chief Financial Officer. |

Please see the section entitled “Management After the Acquisition.”

| Q: | What is the VIE Structure? |

| A: | As a part of the restructure of Sen Lang, its subsidiaries and SenlangBio and its subsidiary (collectively, the “Acquired Companies”) before the closing of the Acquisition, SenlangBio and SenlangBio Clinical Laboratory will be controlled by the PRC Subsidiary by entering into a series of variable interest entities agreements among the PRC Subsidiary, SenlangBio and all current shareholders of SenlangBio, as well as the Investor (such agreements are collectively referred to as the “VIE Agreements”, and such contractual control arrangement is referred to as the “VIE Structure”). |

In the PRC, the VIE structure has become a popular and widely used overseas listing mode for enterprises in the sectors which are foreign investment restricted or prohibited, like the development and application of genetic diagnosis and treatment technology, which includes SenlangBio’s business. The VIE structure refers to an agreement mode in which the PRC domestic operating entity is separated from the overseas-listed entity, and the overseas-listed party/holding company controls the domestic operating entity by signing relevant agreements with the parties who would otherwise receive the benefits of ownership of SenlangBio and control its operations (i.e., VIE Agreements), and is able to consolidate the financial statements of the PRC domestic operating entity into the overseas-listed entity/holding company. After the completion of the overall VIE Structure, the interests/profits from the domestic operation, as well as operational control, have been transferred to the overseas listing/holding company.

It is a condition to closing under the Purchase Agreement that SenlangBio, the PRC Subsidiary and the shareholders of SenlangBio (including the Investor) execute the VIE Agreements. These VIE Agreements include (i) an exclusive technical consultation and service agreement; (ii) an exclusive purchase option agreement; (iii) an entrustment agreement of shareholders’ rights; (iv) a share pledge agreement; and (v) a spouse consent letter.

| Q: | What conditions must be satisfied to complete the Acquisition? |

| A: | There are a number of closing conditions in the Purchase Agreement, including that Avalon’s stockholders approve the issuance of the Acquisition Shares and the Exchange Shares in accordance with Nasdaq rules and that Avalon consummate the Equity Financing. In addition, the VIE Agreements (as defined below) must have been executed and delivered. For a summary of the conditions that must be satisfied or waived prior to completion of the Acquisition, please see the section entitled “The Purchase Agreement—Conditions to the Closing of the Acquisition.” |

| Q: | What vote is required to approve the proposals presented at the Avalon annual meeting of stockholders? |

| A: | The approval of each of the Auditor Proposal, the Nasdaq Proposal, and the Adjournment Proposal requires the affirmative vote of the holders of a majority of votes cast by the stockholders present in person or represented by proxy and entitled to vote thereon at the annual meeting, and the approval of the Director Election Proposal requires the affirmative vote of a plurality of the votes properly cast on the election of directors. Accordingly, abstentions and broker non-votes, if any, will have no effect on the outcome of the Director Election Proposal, the Auditor Proposal, the Nasdaq Proposal and the Adjournment Proposal. |

| Q: | How much stock is owned by 5% stockholders, directors, and executive officers? |

| A: | As of June 30, 2021, Avalon’s directors and executive officers beneficially owned approximately 66.3% of the shares of Avalon Common Stock (calculated in accordance with SEC rules that define beneficial ownership) and owned 54,145,161 shares, 63.6% of the issued and outstanding Avalon Common Stock on such date. Although under no contractual or other obligation to do so, all of such directors and executive officers are currently expected to vote in favor of all of the Avalon Proposals, including the Nasdaq Proposal. |

4

| Q: | Are there any subsequent approvals required from the Acquired Companies’ shareholders to approve the Acquisition? |

| A: | No. All of the Sen Lang Shareholders and Sen Lang Beneficial Shareholders executed the Purchase Agreement, and all of the equity of SenlangBio is owned by certain of the Sen Lang Beneficial Shareholders. Therefore, no other proceedings are necessary for the consummation of the Acquisition, other than the execution and delivery of the VIE Agreements by the Investor and the Sen Lang Beneficial Shareholders who are the owners of SenlangBio. |

| Q: | How many votes do Avalon stockholders have at the annual meeting of stockholders? |

| A: | Each share of Avalon Common Stock is entitled to one vote at the annual meeting for each share of Avalon Common Stock held of record as of the record date. As of the close of business on the record date, there were [ ] outstanding shares of Avalon Common Stock. |

| Q: | What interests do Avalon’s current officers and directors have in the Acquisition? |

| A: | Avalon’s board of directors and executive officers may have interests in the Acquisition that are different from, in addition to or in conflict with, yours. |

As of June 30, 2021, Avalon’s directors and executive officers beneficially owned approximately 66.3% of the shares of Avalon Common Stock (calculated in accordance with SEC rules that define beneficial ownership). All of the current executive officers of Avalon will continue in their current positions after the Acquisition, and all of the directors except for Meng Li will continue on the Avalon board after the Acquisition. In addition, On April 10, 2020, in the ordinary course of business, SenlangBio entered into a scientific research project cooperation agreement with Beijing Lu Daopei Hospital Co., Ltd., under which Beijing Lu Daopei Hospital Co., Ltd. conducts scientific research for the interest of SenlangBio on the cytoplasmic CD79a antibody gated multicolor flow cytometry monitoring CD19-CAR-T bridging allogeneic transplantation for the treatment of refractory and relapsed acute B lymphocytic leukemia. SenlangBio provides research funds in the amount of RMB 2 million to Beijing Lu Daopei Hospital Co., Ltd. Beijing Lu Daopei Hospital Co., Ltd. is a wholly-owned subsidiary of an entity whose chairman is Wenzhao Lu, the Chairman and largest shareholder of Avalon.

For more information, please see the sections entitled “The Acquisition—Interests of Avalon’s Directors and Officers in the Acquisition.”

| Q: | What are the U.S. federal income tax consequences of the Acquisition? |

| A: | Neither Avalon nor its stockholders are expected to recognize federal income tax or gain as a result of the Acquisition. |

| Q: | Do Avalon stockholders have appraisal rights if they object to the proposed Acquisition? |

| A: | No. There are no appraisal rights available to holders of shares of Avalon Common Stock in connection with the Acquisition. |

| Q: | What will happen to Avalon if, for any reason, the Acquisition does not close? |

| A: | There are certain circumstances under which the Purchase Agreement may be terminated. Please see the section entitled “The Purchase Agreement—Termination of the Purchase Agreement” for information regarding the parties’ specific termination rights. |

If, as a result of the termination of the Purchase Agreement or otherwise, Avalon is unable to complete the Acquisition by December 31, 2021 or obtain the approval to extend the deadline for Avalon to consummate the Acquisition, the Avalon board of directors may elect to, among other things, attempt to complete another strategic transaction like the Acquisition, attempt to purchase additional assets, enter into collaboration or joint venture agreements or attempt to sell or otherwise dispose of the various assets of Avalon.

| Q: | When is the Acquisition expected to be completed? |

| A: | It is currently anticipated that the Acquisition will be consummated promptly following the Avalon annual meeting of stockholders, provided that all other conditions to the consummation of the Acquisition have been satisfied or waived, including consummation of the Equity Financing. For a description of the conditions to the completion of the Acquisition, please see the section entitled “The Purchase Agreement—Conditions to the Closing of the Acquisition.” |

5

| Q: | When and where will the annual meeting of Avalon stockholders be held? |

| A: | The Avalon annual meeting will be held in a virtual meeting format only. The annual meeting will be held on [ ], 2021 at [ ] [a/p].m. Eastern time. In order to participate in the annual meeting live via the Internet, you must register at [ ] by 11:59 p.m. Eastern Time by [ ], 2021. On the day of the Avalon annual meeting, if you have properly registered, you may enter the annual meeting by logging in using the event password you received via email in your registration confirmation at [ ]. You will not be able to attend the Avalon annual meeting in-person. |

If you are a registered holder, you must register using the virtual control number included in your proxy materials or your proxy card. If you hold your shares beneficially through a bank or broker, you must provide a legal proxy from your bank or broker during registration and you will be assigned a virtual control number in order to vote your shares during the Annual meeting. If you are unable to obtain a legal proxy to vote your shares, you will still be able to attend the Annual meeting (but will not be able to vote your shares) so long as you demonstrate proof of stock ownership. Instructions on how to connect and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at [ ].

| Q: | What do I need to do now? |

| A | You are urged to carefully read and consider the information contained in this proxy statement, including the financial statements and annexes attached hereto, and in the Annual Report and to consider how the Acquisition will affect you. You should then vote as soon as possible in accordance with the instructions provided in this proxy statement on the enclosed proxy card or, if you hold your shares through a brokerage firm, bank or other nominee, on the voting instruction form provided by the broker, bank or nominee. |

| Q: | How do I vote? |

| A: | If you were a holder of Avalon Common Stock on [ ], 2021, the record date for the annual meeting of stockholders, you may provide your proxy instructions in one of three different ways. First, you can mail your signed proxy card in the enclosed return envelope. Second, you may provide your proxy instructions via the Internet by following the instructions on your proxy card or voting instruction form. You may also vote your shares at the annual meeting via live webcast. Please provide your proxy instructions only once, unless you are revoking a previously delivered proxy instruction, and as soon as possible so that your shares can be voted at the annual meeting of Avalon stockholders. |

| Q: | What happens if I do not return a proxy card or otherwise provide proxy instructions, as applicable? |

| A: | Signed and dated proxies received by Avalon without an indication of how the stockholder intends to vote on a proposal will be voted “FOR” each of the Avalon Proposals presented to Avalon’s stockholders in accordance with the recommendation of Avalon’s board of directors. The proxyholders may use their discretion to vote on any other matters which properly come before the Avalon annual meeting. |

| Q: | May I vote in person at the annual meeting of stockholders of Avalon? |

| A: | Due to the public health impact of the coronavirus outbreak (“COVID-19”) and to support the health and well-being of Avalon’s stockholders, the Avalon annual meeting will be held in a virtual meeting format only. If your shares of Avalon Common Stock are registered directly in your name with the Avalon transfer agent, you are considered to be the stockholder of record with respect to those shares, and the proxy materials and proxy card are being sent directly to you by Avalon. If you are an Avalon stockholder of record, you must register using the virtual control number included in your proxy materials or your proxy card (if you received a printed copy of the proxy materials) in order to vote at the annual meeting. If you hold your shares beneficially through a bank or broker, you are considered the beneficial owner of shares held in “street name” and you must provide a legal proxy from your bank or broker during registration and you will be assigned a virtual control number in order to vote your shares during the annual meeting. If you are unable to obtain a legal proxy to vote your shares, you will still be able to attend the annual meeting, so long as you demonstrate proof of stock ownership, but you will not be able to vote your shares. Even if you plan to attend the Avalon annual meeting live via the internet, Avalon encourages you to vote in advance by internet or mail so that your vote will be counted if you later decide not to attend the annual meeting live via the internet. |

For more information, please see the section entitled “The Annual Meeting of Avalon Stockholders—Voting Your Shares.”

6

| Q: | If my Avalon shares are held in “street name” by my broker, will my broker vote my shares for me? |

| A: | If you are a beneficial owner of shares of Avalon Common Stock and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the New York Stock Exchange (the “NYSE”), deems the particular proposal to be a “routine” matter and how your broker or nominee exercises any discretion they may have in the voting of the shares that you beneficially own. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholder, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. |

For any Avalon Proposal that is considered a “routine” matter, your broker or nominee may vote your shares in its discretion either for or against the proposal even in the absence of your instruction. For any Avalon Proposal that is considered a “non-routine” matter for which you do not give your broker instructions, the shares will be treated as broker non-votes. Broker non-votes occur when a beneficial owner of shares held in street name does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Broker non-votes will not be considered to be shares “entitled to vote” at the annual meeting and will not be counted as having been voted on the applicable proposal. Avalon currently anticipates that only the Auditor Proposal is likely to be deemed routine by the NYSE.

| Q: | May I change my vote after I have submitted a proxy or provided proxy instructions? |

| A: | Yes. Avalon stockholders of record may change their vote at any time before their proxy is voted at the Avalon annual meeting, as applicable, in one of the following ways: |

| ● | filing with the Secretary of Avalon, a letter revoking the proxy; |

| ● | submitting another signed proxy with a later date; or |

| ● | attending the Avalon annual meeting and voting online, provided you file a written revocation with the Secretary of the Avalon annual meeting prior to the voting of such proxy. |

| Q: | What is the quorum requirement for the annual meeting of stockholders? |

| A: | The holders of at least a majority of the voting power of the outstanding shares of Avalon Common Stock entitled to vote, as of the record date, represented in person or by proxy, will constitute a quorum for the transaction of business at the Avalon annual meeting. Proxies marked as abstentions and broker non-votes, if any, will be included to determine the number of shares present at the annual meeting. In the absence of a quorum, a majority of Avalon’s stockholders, present in person or represented by proxy, and voting thereon will have the power to adjourn the annual meeting. As of the record date for the annual meeting, [ ] shares of Avalon Common Stock would be required to achieve a quorum. |

7

| Q: | What risks should I consider in deciding whether to vote in favor of the Avalon Proposals? |

| A: | You should carefully review this proxy statement and the Annual Report, including the sections entitled “Risk Factors,” which set forth certain risks and uncertainties related to the Acquisition, risks and uncertainties to which the post-Acquisition company’s business will be subject, and risks and uncertainties to which each of Avalon and SenlangBio, as an independent company, is subject. |

Q: How are proxy materials delivered to households?

A: Only one copy of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020 and this Proxy Statement will be delivered to an address where two or more stockholders reside with the same last name or who otherwise reasonably appear to be members of the same family based on the stockholders’ prior express or implied consent.

We will deliver promptly upon written or oral request a separate copy of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020 and this Proxy Statement. If you share an address with at least one other stockholder, currently receive one copy of our Annual Report on Form 10-K and Proxy Statement at your residence, and would like to receive a separate copy of our Annual Report on Form 10-K and Proxy Statement for future stockholder meetings of the Company, please specify such request in writing and send such written request to Avalon GloboCare Corp., 4400 Route 9 South, Suite 3100, Freehold, New Jersey 07728; Attention: Chief Financial Officer.

If you want to receive separate copies of the Company’s proxy statement and annual report in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker or other nominee record holder, or you may contact us at Avalon’s address and telephone number.

| Q: | Who will solicit and pay the cost of soliciting proxies? |

| A: | Avalon will bear all costs and expenses in connection with the solicitation of proxies, including the costs of preparing, printing and mailing this proxy statement and the Annual Report for the Avalon annual meeting. |

| Q: | Who can help answer my questions? |

| A: | If you are an Avalon stockholder and would like additional copies, without charge, of this proxy statement and the Annual Report, or if you have questions about the Acquisition, including the procedures for voting your shares, you should contact Avalon at: |

Avalon GloboCare Corp.

4400 Route 9 South, Suite 3100

Freehold, New Jersey 07728

732-780-4400

8

SUMMARY OF THE PROXY STATEMENT

This summary highlights selected information from this proxy statement and does not contain all of the information that is important to you. To better understand the Acquisition and the other proposals to be considered at the annual meeting, you should read this entire proxy statement carefully, including the annexes. Please see the section entitled “Where You Can Find More Information.”

The Annual Meeting

The annual meeting is being held for the following purposes:

| 1. | The “Director Election Proposal”—to elect the nine director nominees named in the proxy statement to hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified; |

| 2. | The “Auditor Proposal”—to ratify the appointment of Marcum LLP as the Company’s independent auditors for the fiscal year ending December 31, 2021; and |

| 3. | The “Nasdaq Proposal”— to approve, pursuant to the rules of the Nasdaq Stock Market, the issuance of (i) the Acquisition Shares pursuant to the terms of the Purchase Agreement and (ii) the Exchange Shares (the “Nasdaq Proposal”); | |

| 4. | The “Adjournment Proposal”—to approve the adjournment of the annual meeting to a later date or time, if necessary, to solicit additional proxies if, based upon the tabulated vote at the time of the annual meeting, there are not sufficient votes to approve the Nasdaq Proposal. |

Avalon

Avalon GloboCare Corp. is a clinical-stage, vertically integrated, leading CellTech bio-developer dedicated to advancing and empowering innovative, transformative immune effector cell therapy, exosome technology, as well as COVID-19 related diagnostics and therapeutics. Avalon also provides strategic advisory and outsourcing services to facilitate and enhance its clients' growth and development, as well as competitiveness in healthcare and CellTech industry markets. Through its subsidiary structure with unique integration of verticals from innovative R&D to automated bioproduction and accelerated clinical development, Avalon is establishing a leading role in the fields of cellular immunotherapy (including CAR-T/NK), exosome technology (ACTEX™), and regenerative therapeutics.

The principal executive offices of Avalon are located at 4400 Route 9 South, Suite 3100, Freehold, New Jersey 07728, and its telephone number is (732) 780-4400.

SenlangBio

SenlangBio is a clinical-stage biotechnology company that focuses on three advanced technology platforms—CAR T-cells, CAR γδT-cells and armTILs—to develop a robust pipeline of innovative and transformative cellular immunotherapies for cancer patients. Chimeric antigen receptor (CAR) T-cells (CAR-T) are natural cell-killing T-cells that have been engineered to specifically recognize and kill cancerous cells. Allogeneic (universal) CAR γδT-cells (CAR-GDT) are a specific class of donor-derived T-cells that can provide superior anti-tumor effectiveness. Armored tumor infiltrating lymphocytes (armTILs) are cancer-killing T-cells that provide a unique “personalized” cellular immunotherapy approach.

SenlangBio is currently the largest cell therapy company in Northern China in terms of the scale of bio-manufacturing, as well as the breadth and depth of active pre-clinical research and clinical development programs.

A wholly-owned subsidiary of SenlangBio, Shijiazhuang Senlang Medical Laboratory Co., Ltd., a company with limited liability organized and existing under the laws of the PRC (“SenlangBio Clinical Laboratory”) is engaged in the business of testing of immunology, serology and molecular genetics specialties for patients, including hematology-tumor diagnostics and testing prior to clinical trials for cell therapy.

The principal executive offices of SenlangBio are located at Room 512 and 513, Building 1, 136 Yellow River Avenue, Shijiazhuang High-tech Development Zone, Hebei Province, China, and its telephone number is +86-311-82970975.

9

Sen Lang

Lonlon Biotech Ltd., a company incorporated in the British Virgin Islands (“BVI”) (“Sen Lang”), the ultimate beneficial owner and controlling entity of SenlangBio through the VIE Structure, was established on October 15, 2020 to be a holding company of Lonlon Biotech Investment Limited (“Senlang HK”), which owns 100% of the equity of Beijing Langlang Runfeng Biotechnology Co., Ltd., a wholly foreign owned enterprise with limited liability organized and existing under the laws of the PRC (the “PRC Subsidiary”), and the PRC Subsidiary is the beneficiary of SenlangBio through the VIE Structure.

The principal executive offices of Sen Lang are located at 5F, Huabin Center, Jianguomen Wai Ave, Chaoyang District, Beijing, China, 100022.

On June 13, 2021, Avalon GloboCare Corp., a Delaware corporation (the “Company” or “Avalon”), entered into a Share Purchase Agreement (the “Purchase Agreement”), by and among the Company, Lonlon Biotech Ltd., a company incorporated in the British Virgin Islands (“BVI”) (“Sen Lang”), the holders of the share capital of Sen Lang (the “Sen Lang Shareholders”), the ultimate beneficial owners of the Sen Lang Shareholders (the “Sen Lang Beneficial Shareholders” and, together with the Sen Lang Shareholders, the “Sen Lang Owners”) and a representative of the Sen Lang Owners (the “Sen Lang Representative”). Pursuant to the Purchase Agreement, subject to the satisfaction of the conditions to closing therein, including approval by the Avalon stockholders pursuant to the rules of the Nasdaq Stock Market (“Nasdaq”), Avalon agreed to purchase (the “Acquisition”) all of the issued and outstanding share capital of Sen Lang (the “Sen Lang Shares”).

Sen Lang, through a “variable interest entity” structure (described in more detail below under “VIE Structure”) of contractual rights held by its wholly-owned subsidiary Beijing Langlang Runfeng Biotechnology Co., Ltd., a wholly foreign owned enterprise with limited liability organized and existing under the laws of the People’s Republic of China (the “PRC”) (the “PRC Subsidiary”), has full economic benefit and management control over, and is consolidated for accounting purposes with, Senlang Biotechnology Co. Ltd., a PRC domestic company with limited liability organized and existing under the laws of the PRC (the “OpCo” or “SenlangBio”). SenlangBio is mainly engaged in the business of research and development in relation to CAR-T cell therapy, immune cell therapy and related drug development. SenlangBio is owned 100% by certain of the Sen Lang Beneficial Shareholders. A wholly-owned subsidiary of SenlangBio, Shijiazhuang Senlang Medical Laboratory Co., Ltd., a company with limited liability organized and existing under the laws of the PRC (“SenlangBio Clinical Laboratory”) is engaged in the business of testing of immunology, serology and molecular genetics specialties for patients, including hematology-tumor diagnostics and testing prior to clinical trials for cell therapy. For a more detailed discussion of the business of SenlangBio and SenlangBio Clinical Laboratory, please see the section entitled “Information about SenlangBio.”

The purchase price being paid by Avalon to the Sen Lang Shareholders under the Purchase Agreement for the Sen Lang Shares is an aggregate of 81 million shares (the “Acquisition Shares”) of the common stock, par value US$0.0001 per share, of Avalon (the “Avalon Common Stock”). Ten percent (10%), or 8.1 million, of such shares will be held in escrow for 12 months following the closing to satisfy any indemnification obligations of the Sen Lang Shareholders under the Share Purchase Agreement. In addition, at the closing of the Acquisition, it is expected that Dr. Jianqiang Li, scientific founder and CSO of SenlangBio, will join the board of the Company, and Dr. Li will also be appointed as Chief Technology Officer of the Company. The Acquisition Shares will not be registered under the Securities Act of 1933, as amended (the “Securities Act”) and, therefore, will be restricted securities under Rule 144 under the Securities Act for six months or longer after the closing of the Acquisition, subject to “affiliate” status with the Company under the Securities Act.

A copy of the Purchase Agreement is attached to this proxy statement as Annex A. For a more detailed discussion of the Purchase Agreement, please see the section entitled “The Purchase Agreement.”

10

Conditions to the Closing of the Acquisition

The Avalon stockholders must approve the Nasdaq Proposal. The approval of the Nasdaq Proposal requires the affirmative vote of the holders of a majority of votes cast by the stockholders present in person or represented by proxy and entitled to vote thereon at the annual meeting.

In addition, Avalon must consummate the Equity Financing and the VIE Agreements must have been executed and delivered. Please see the section entitled “The Purchase Agreement—Conditions to the Closing of the Acquisition.”

Non-Solicitation

In the Purchase Agreement, Sen Lang and its affiliates agreed not to (i) solicit, initiate, or encourage the submission of any proposal or offer from any person relating to the acquisition of the equity or assets of Sen Lang, its subsidiaries and SenlangBio and its subsidiaries (collectively, the “Acquired Companies”) or (ii) enter into or renew any distribution agreement related to the business of the Acquired Companies, in each case without the prior written consent of Avalon.

Termination of the Purchase Agreement

Either Avalon or the Sen Lang Representative can terminate the Purchase Agreement under certain circumstances, which would prevent the Acquisition from being consummated. For more information, please see the section entitled “The Purchase Agreement—Termination of the Purchase Agreement.”

In connection with the Acquisition, on June 13, 2021, an institutional investor (the “Investor”) entered into an agreement, as amended on June 24, 2021, with SenlangBio related to the purchase of registered capital of SenlangBio (the “OpCo Capital Increase Agreement”) pursuant to which the Investor will acquire an aggregate of up to 13.5% of the equity ownership of SenlangBio for an aggregate purchase price (the “Subscription Amount) of approximately US$30,000,000 (represented by an actual investment of RMB200,000,000) (the “Equity Financing”), which funds will be invested in SenlangBio in three equal installments of approximately US$10,000,000, at a fixed price, the first to be upon the closing of the Acquisition, the second to be within three months after the closing and the third to be within six months after the closing. In addition, pursuant to a Securities Exchange Agreement, as amended on June 24, 2021 (the “Exchange Agreement”), by and among the Company, Sen Lang, SenlangBio and the Investor, dated June 13, 2021, the Investor shall have the right, exercisable between the six-month and five year-anniversaries of the respective initial closing and installment closings, to elect to exchange, from time to time, all or part of its then-owned equity ownership of SenlangBio for shares (the “Exchange Shares”) of Avalon Common Stock at a fixed exchange price of US$1.21 per share of Avalon Common Stock, which was the market price of the Avalon Common Stock as of the date of the Exchange Agreement under Nasdaq rules. In addition, the Exchange Agreement provides that the Investor may only exchange up to 10% of its total investment amount in any 30 day period.

As a part of the restructure of Sen Lang, its subsidiaries and SenlangBio and its subsidiaries (collectively, the “Acquired Companies”) before the closing of the Acquisition, SenlangBio and SenlangBio Clinical Laboratory will be controlled by the PRC Subsidiary by entering into a series of variable interest entities agreements among the PRC Subsidiary, SenlangBio and all current shareholders of SenlangBio, as well as the Investor (such agreements are collectively referred to as the “VIE Agreements”, and such contractual control arrangement is referred to as the “VIE Structure”).

11

In the PRC, the VIE structure has become a popular and widely used overseas listing mode for enterprises in the sectors which are foreign investment restricted or prohibited, like the development and application of genetic diagnosis and treatment technology, which includes SenlangBio’s business. The VIE structure refers to an agreement mode in which the PRC domestic operating entity is separated from the overseas-listed entity, and the overseas-listed party/holding company controls the domestic operating entity by signing relevant agreements with the parties who would otherwise receive the benefits of ownership of SenlangBio and control its operations (i.e., VIE Agreements), and is able to consolidate the financial statements of the PRC domestic operating entity into the overseas-listed entity/holding company. After the completion of the overall VIE Structure, the interests/profits from the domestic operation, as well as operational control, have been transferred to the overseas listing/holding company.

It is a condition to closing under the Purchase Agreement that SenlangBio, the PRC Subsidiary and the shareholders of SenlangBio (including the Investor) execute the VIE Agreements. These VIE Agreements include (i) an exclusive technical consultation and service agreement; (ii) an exclusive purchase option agreement; (iii) an entrustment agreement of shareholders’ rights; (iv) a share pledge agreement; and (v) a spouse consent letter.

Interests of Certain Persons in the Acquisition

Avalon

In considering the recommendation of Avalon’s board of directors to vote in favor of the Avalon Proposals, stockholders should be aware that, aside from their interests as stockholders, certain Avalon directors and officers have interests in the Acquisition that are different from, or in addition to, those of other stockholders generally. Avalon’s directors were aware of and considered these interests, among other matters, in evaluating the Acquisition, and in recommending to stockholders that they approve the Avalon Proposals. Stockholders should take these interests into account in deciding whether to approve the Avalon Proposals.

As of June 30, 2021, Avalon’s directors and executive officers beneficially owned approximately 66.3% of the shares of Avalon Common Stock (calculated in accordance with SEC rules that define beneficial ownership). All of the current executive officers of Avalon will continue in their current positions after the Acquisition, and all of the directors except for Meng Li will continue on the Avalon board after the Acquisition. In addition, on April 10, 2020, in the ordinary course of business, SenlangBio entered into a scientific research project cooperation agreement with Beijing Lu Daopei Hospital Co., Ltd., under which Beijing Lu Daopei Hospital Co., Ltd. conducts scientific research for the interest of SenlangBio on the cytoplasmic CD79a antibody gated multicolor flow cytometry monitoring CD19-CAR-T bridging allogeneic transplantation for the treatment of refractory and relapsed acute B lymphocytic leukemia. SenlangBio provides research funds in the amount of RMB 2 million to Beijing Lu Daopei Hospital Co., Ltd. Beijing Lu Daopei Hospital Co., Ltd. is a wholly-owned subsidiary of an entity whose chairman is Wenzhao Lu, the Chairman and largest shareholder of Avalon.

These interests may influence Avalon’s board of directors in making their recommendation that you vote in favor of the approval of the Avalon Proposals.

For more information, please see the section entitled “The Acquisition—Interests of Avalon’s Directors and Officers in the Acquisition.”

Reasons for the Approval of the Acquisition

After careful consideration, Avalon’s board of directors recommends that Avalon stockholders vote “FOR” each of the Avalon Proposals being submitted to a vote of the Avalon stockholders at the Avalon annual meeting of stockholders.

For a description of Avalon’s reasons for the approval of the Acquisition and the recommendation of its board of directors, see the section entitled “The Acquisition—Reasons for the Acquisition.”

12

Regulatory Approvals Required for the Acquisition

Avalon must comply with applicable federal and state securities laws and the rules and regulations of Nasdaq in connection with the issuance of shares of Avalon Common Stock in connection with the Acquisition and the issuance of the Exchange Shares in the Equity Financing and the filing of this proxy statement with the SEC.

Accounting Treatment of the Acquisition

The Acquisition is expected to be accounted for as a business acquisition, with Avalon identified as the accounting acquirer. Avalon is considered the accounting acquirer since immediately following the closing: (i) Avalon stockholders will own a majority of the voting rights of the post-Acquisition company; (ii) Avalon will have designate a majority (eight of nine) of the initial members of the board of directors of the post-Acquisition company; (iii) Avalon’s senior management will hold the majority of the key positions in senior management of the post-Acquisition company; and (iv) Avalon will continue to maintain its corporate headquarters in Freehold, New Jersey, United States. SenlangBio will continue to maintain operations in the Shijiazhuang High-tech Development Zone, Hebei Province, China.

The acquisition consideration is 81,000,000 shares of Avalon Common Stock. The purchase price will be allocated to the acquired assets and assumed liabilities based on their fair values at the closing date, and any excess is initially allocated to identifiable intangible assets mainly consisting of cell and gene engineering technologies with the ability to generate innovative and transformative cellular immunotherapies for solid and hematologic cancers, which will be amortized over 10 years. The initial allocation is subject to change upon the final valuation which is to be done at the time of closing. Such change could have a material impact on Avalon’s financial statements.

Material U.S. Federal Income Tax Consequences of the Acquisition

Neither Avalon nor its stockholders are expected to recognize federal income tax or gain as a result of the Acquisition.

Ownership Following the Acquisition and the Equity Financing

It is anticipated that, upon the consummation of the Acquisition, the ownership of Avalon will be as follows:

| ● | Current Avalon stockholders will own 51.0% of the total voting shares outstanding; and |

| ● | Current Sen Lang Shareholders will own 49.0% of the total voting shares outstanding. |

The numbers of shares and percentage interests set forth above do not take into account (i) shares of Avalon Common Stock issuable upon the exchange of shares of SenlangBio purchased by the Investor in the Equity Financing, pursuant to the Exchange Agreement, (ii) shares of Avalon Common Stock issuable upon the exercise of outstanding options and warrants and (iii) potential future issuances of Avalon securities.

In addition, under the Exchange Agreement, the Investor shall have the right, exercisable following the six month anniversary of the closing of the Acquisition and until the five year anniversary of the closing of the Acquisition, to elect to exchange, from time to time, all or part of its equity ownership of SenlangBio for Exchange Shares of Avalon at an effective exchange price of $1.21 per share of Avalon Common Stock. Following the completion of the financing and assuming the full funding by the investor in the financing, the aggregate number of shares of Avalon Common Stock that would be issuable under the Exchange Agreement (assuming the exchange of all shares) would be approximately 25,885,000 (using the conversion rate of US dollars to RMB of 6.3856 as of June 11, 2021). The resultant equity ownership of Avalon would be as follows:

| ● | Current Avalon stockholders will own 44.1% of the total voting shares outstanding; |

| ● | Current Sen Lang Shareholders will own 42.4% of the total voting shares outstanding and |

| ● | The Investor will own 13.5% of the total voting shares outstanding. |

13

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this proxy statement may constitute “forward-looking statements” for purposes of the federal securities laws. Our forward-looking statements include, but are not limited to, statements regarding Avalon, Avalon’s management team’s, SenlangBio and SenlangBio’s management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Actual results may differ materially from Avalon’s and SenlangBio’s current expectations depending upon a number of factors. These factors include, among others:

| ● | the inherent uncertainty associated with financial projections, restructuring in connection with, and successful consummation of, the Acquisition; |

| ● | subsequent integration of Avalon’s and SenlangBio’s businesses and the ability to recognize the anticipated synergies and benefits of the Acquisition; |

| ● | the inability to complete the Acquisition due to the failure to satisfy conditions to the closing in the Purchase Agreement and/or the failure the complete the Equity Financing; |

| ● | the post-Acquisition company’s financial and business performance following the Acquisition, including plans to develop and commercialize additional products; |

| ● | changes in SenlangBio’s and Avalon’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects and plans; |

| ● | developments and projections relating to the post-Acquisition company’s competitors or industry; |

| ● | the impact of health epidemics, including the COVID-19 pandemic, on the business of Avalon and SenlangBio; |

| ● | the ability to protect and maintain the post-Acquisition company’s intellectual property protection and not infringe on the rights of others; |

| ● | developments and projections relating to the post-Acquisition company’s competitors or industry; |

| ● | future regulatory, judicial and legislative changes in Avalon’s or SenlangBio’s industry; |

| ● | access to available financing (including the Equity Financing in connection with the Acquisition) on a timely basis and on reasonable terms; |

| ● | the receipt of required regulatory approvals for the Acquisition; |

| ● | the diversion of management time on Acquisition-related issues; |

| ● | the inability to maintain the listing of Avalon Common Stock on Nasdaq following the Acquisition; |

| ● | the outcome of any legal proceedings that may be instituted against Avalon following announcement of the proposed Acquisition and transactions contemplated thereby; and |

| ● | other risks and uncertainties described in this proxy statement and in the Annual Report, including those in the sections entitled “Risk Factors.” |

These forward-looking statements are based on information available as of the date of this proxy statement, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Except as expressly required by law, including the securities laws of the United States, Avalon and SenlangBio disclaim any intent or obligation to update or revise these forward-looking statements.

14

THE ANNUAL MEETING OF AVALON STOCKHOLDERS

Avalon is furnishing this proxy statement to you as part of the solicitation of proxies by its board of directors for use at the annual meeting, and at any adjournment or postponement thereof. This proxy statement is first being furnished to Avalon’s stockholders on or about [ ], 2021. This proxy statement provides you with information you need to know to be able to vote or instruct your vote to be cast at the annual meeting of stockholders.

Date, Time and Place of the Annual Meeting

Due to the public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of Avalon’s stockholders, the Avalon annual meeting will be held in a virtual meeting format only. The annual meeting of stockholders of Avalon will be held at [ ] [a/p].m. Eastern time, on [ ], 2021, at [LINK], or such other date, time and place to which such meeting may be adjourned or postponed, for the purpose of considering and voting upon the proposals.

On the day of the Avalon annual meeting, if you have properly registered, you may enter the annual meeting by logging in using the event password you received via email in your registration confirmation at [OTHER LINK]. You will not be able to attend the Avalon annual meeting in-person.

At the Avalon annual meeting of stockholders, Avalon will ask the Avalon stockholders to vote in favor of the following proposals: