Exhibit 99.1

www.avalon - globocare.com Nasdaq: ALBT September 202 5 Corporate Presentation

Forward - Looking Statements 2 2 Certain statements contained in this presentation may constitute “forward - looking statements”, which provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact . Actual results may differ materially from those indicated by such forward - looking statements as a result of various important factors as disclosed in our filings with the Securities and Exchange Commission located at their website ( http : //www . sec . gov ) . In addition to these factors, actual future performance, outcomes, and results may differ materially because of more general factors including (without limitation) general industry and market conditions and growth rates, economic conditions, and governmental and public policy changes . The forward - looking statements included in this presentation represent the Company's views as of the date of this presentation and these views could change . However, while the Company may elect to update these forward - looking statements at some point in the future, the Company specifically disclaims any obligation to do so . These forward - looking statements should not be relied upon as representing the Company's views as of any date subsequent to the date of this presentation . Forward - Looking Statements

Forward - Looking Statements 2 2 No Offer or Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any proxy, consent, authorization, vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended (the “Securities Act”) . Additional Information About the Proposed Merger for Investors and Shareholders This communication relates to the proposed Merger of the Company and YOOV . In connection with the proposed Merger, the Company has filed relevant materials with the U . S . Securities and Exchange Commission (the “SEC”), including a Registration Statement on Form S - 4 , as amended, that contains a preliminary prospectus and preliminary proxy statement of the Company (the “proxy statement/prospectus”) . This Registration Statement has not yet been declared effective and the Company has filed or may file other documents regarding the proposed Merger with the SEC . This communication is not a substitute for the proxy statement/prospectus or for any other document that the Company has filed or may file with the SEC in connection with the proposed Merger . No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act . INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY CONTAIN IMPORTANT INFORMATION THAT STOCKHOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING THE PROPOSED MERGER . A definitive proxy statement/prospectus will be sent to the Company’s stockholders . Investors and security holders will be able to obtain these documents (when available) free of charge from the SEC’s website at www . sec . gov . In addition, investors and stockholders should note that the Company communicates with investors and the public using its website (https : //www . avalon - globocare . com), the investor relations website (https : //www . avalon - globocare . com/investors) where anyone will be able to obtain free copies of the proxy statement/prospectus and other documents filed by the Company with the SEC, and stockholders are urged to read the proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed Merger . Participants in the Solicitation The Company, YOOV and their respective directors and executive officers and other members of management and employees and certain of their respective significant stockholders may be deemed to be participants in the solicitation of proxies from the Company and YOOV stockholders in respect of the proposed Merger . Information about the Company’s directors and executive officers is available in the Company’s Form 10 - K for the fiscal year ended December 31 , 2024 , which was filed with the SEC on March 31 , 2025 . Information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holding or otherwise, has been and will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed Merger when they become available . Investors should read the definitive proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions . You may obtain free copies of these documents from the SEC and the Company as indicated above . Additional Information About the Proposed Merger for Investors and Shareholders

Forward - Looking Statements 2 2 This investor presentation contains additional information regarding YOOV , including certain preliminary financial data with respect to YOOV . The actual amounts that YOOV will report will be subject to its financial closing procedures and any final adjustments that may be made prior to the time its audited financial results for the year ended March 31 , 2025 are finalized and filed with the U . S . Securities and Exchange Commission . The preliminary financial data included therein has been prepared by, and is the responsibility of, the management of YOOV . YOOV’s independent registered public accounting firm has not audited, reviewed, compiled, or applied agreed - upon procedures with respect to the preliminary financial data and, accordingly, does not express an opinion or any other form of assurance with respect thereto . This estimate should not be viewed as a substitute for audited financial statements prepared in accordance with accounting principles generally accepted in the United States . It does not reflect any updates following March 31 , 2025 , or consider any events or circumstances after the date that it was prepared, and is not necessarily indicative of the results to be achieved in any future period . Accordingly, you should not place undue reliance on this preliminary estimate . Preliminary Financial Data

Mission: Avalon GloboCare Corp. (Nasdaq: ALBT) is a developer of precision diagnostic consumer products and the advancement of intellectual property in cellular therapy. History: Founded in 2016; successfully uplisted to Nasdaq in December 2018; Headquarters in Freehold, New Jersey . Core Technology Platforms: • KetoAir breathalyzer device nanosensor technology • QTY protein design platform joint intellectual property with Massachusetts Institute of Technology (MIT) Corporate Overview and Highlights Nasdaq: ALBT 5

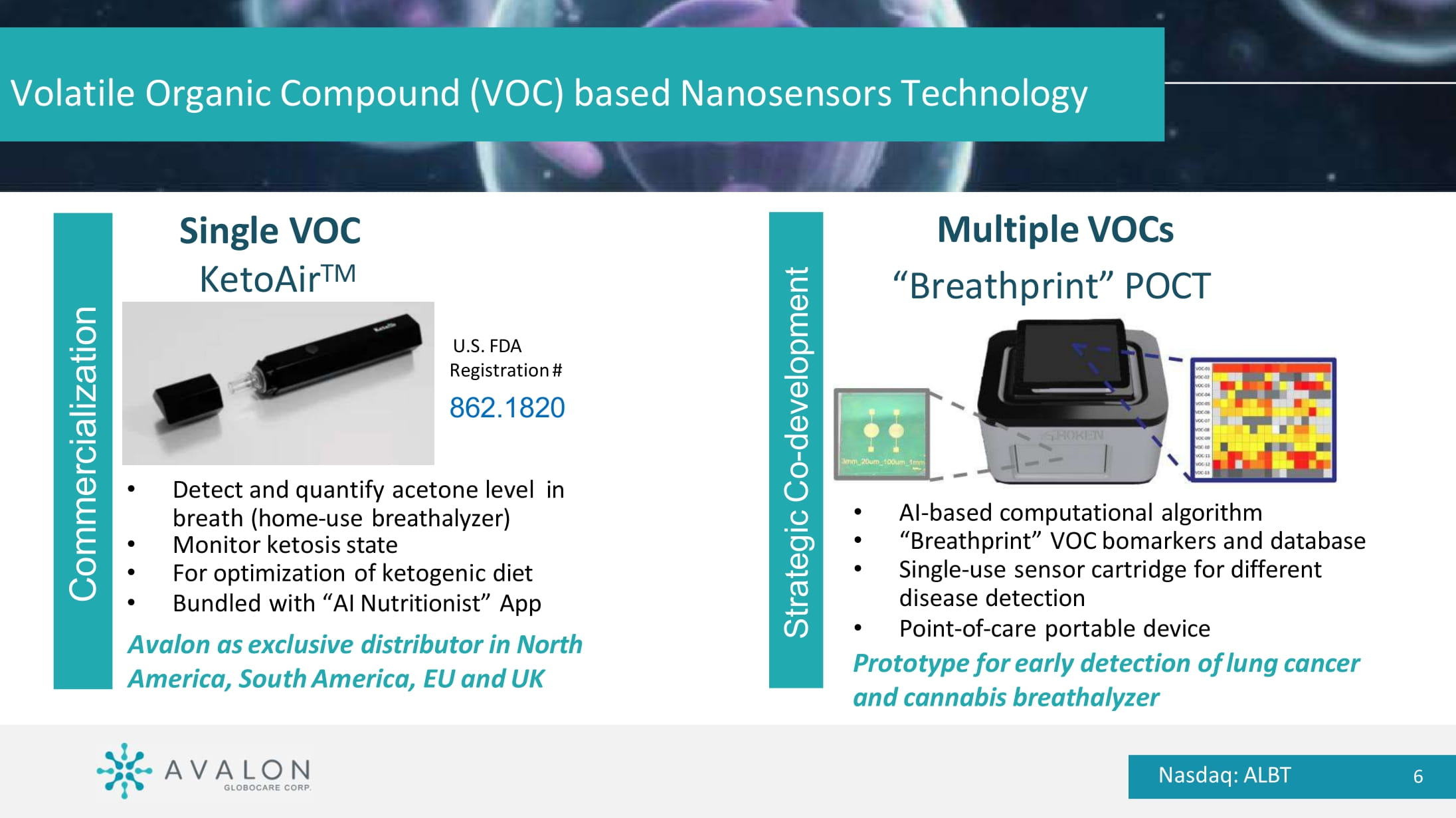

Volatile Organic Compound (VOC) based Nanosensors Technology Multiple VOCs “Breathprint” POCT • AI - based computational algorithm • “Breathprint” VOC bomarkers and database • Single - use sensor cartridge for different disease detection • Point - of - care portable device Prototype for early detection of lung cancer and cannabis breathalyzer Single VOC KetoAir TM U.S. FDA Registration # 862.1820 • Detect and quantify acetone level in breath (home - use breathalyzer) • Monitor ketosis state • For optimization of ketogenic diet • Bundled with “AI Nutritionist” App Avalon as exclusive distributor in North America, South America, EU and UK Commercialization Strategic Co - development Nasdaq: ALBT 6

Summary Nanosensor Technology Nasdaq: ALBT 7 Jointly Filed Patents (including USPTO, PCT) • Detect and quantify acetone level in breath (home - use breathalyzer) • Monitor ketosis state • For optimization of ketogenic diet • Bundled with “AI Nutritionist” App Exclusive Distributor in N. America, South America, EU and UK • Broad and deep IP assets and portfolio, with patent coverage across a number of key enabling technologies in CellTech and laboratory medicine Intellectual Property

• Entered into definitive merger agreement on March 7, 2025 with YOOV Group Holding Limited (“YOOV”), an AI - as - a - Service ( AIaaS ) platform specializing in intelligent business automation through advanced AI and robotic process automation (RPA). Over 50 employees across Hong Kong, Malaysia, Australia, and Taiwan. • YOOV expects unaudited FY2025 results for the year ended March 30, 2025, with revenue of $59.3M and net income of $3.8M, nearly doubling revenue and delivering 206% net income growth year - over - year. • The Merger, expected to close in Q4 2025, will result in a publicly - traded company focused on empowering organizations of all sizes to optimize operations, reduce costs, and enhance service delivery through AIaaS solutions, specializing in intelligent business automation. Definitive Merger Agreement with YOOV Nasdaq: ALBT 8

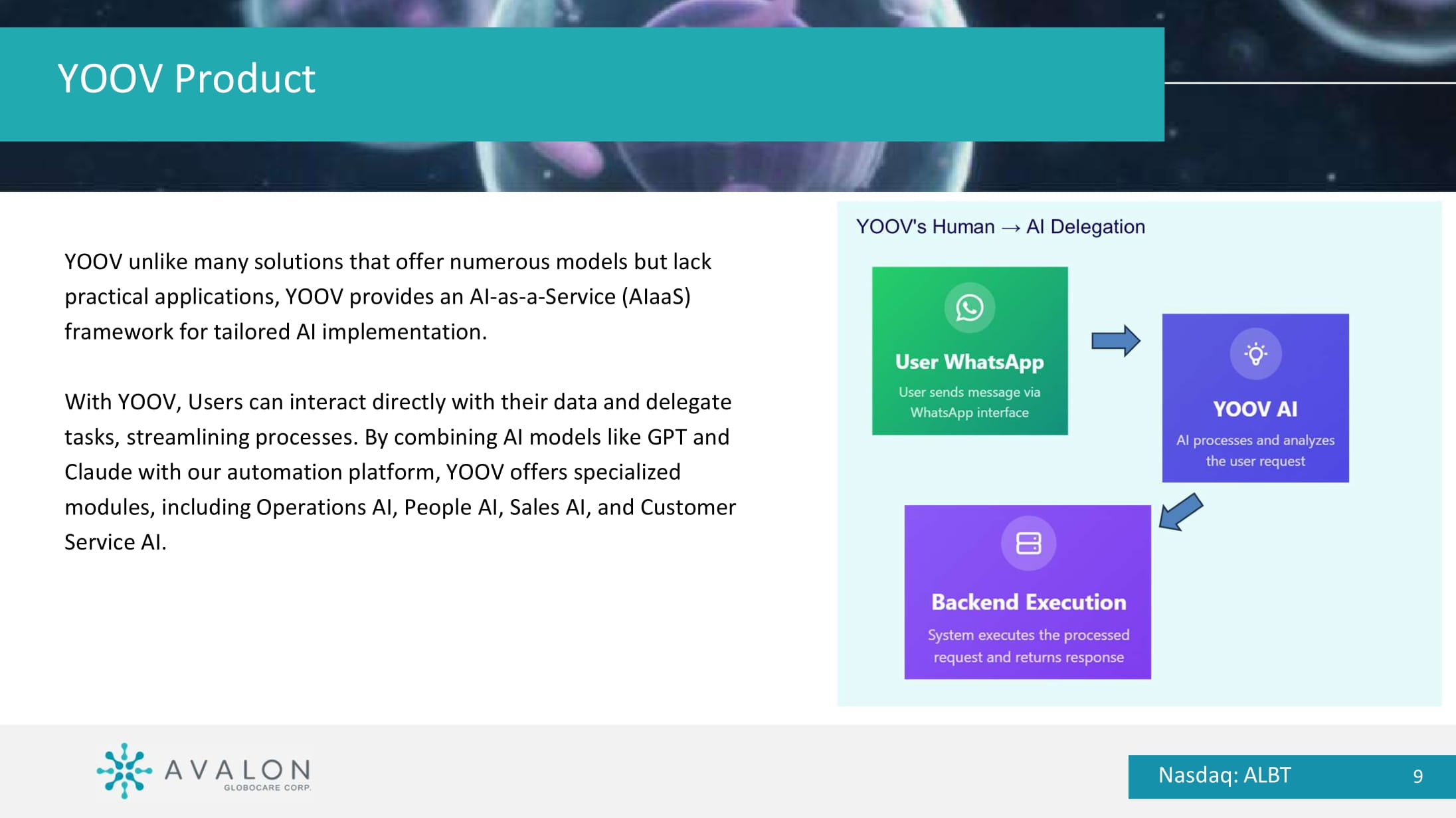

YOOV Product Nasdaq: ALBT 9 YOOV unlike many solutions that offer numerous models but lack practical applications, YOOV provides an AI - as - a - Service ( AIaaS ) framework for tailored AI implementation. With YOOV, Users can interact directly with their data and delegate tasks, streamlining processes. By combining AI models like GPT and Claude with our automation platform, YOOV offers specialized modules, including Operations AI, People AI, Sales AI, and Customer Service AI.

Competitive Landscape – Business AI Automation Nasdaq: ALBT 10 Highly competitive market as enterprises and SMEs adopt automation for efficiency & advantage. • Large Enterprise Software Companies – Strong brands, advanced AI, but complex and enterprise - focused. • AI Model / Solution Providers – Offer AI tools/models, not full end - to - end automation. • Specialized AIaaS / RPA Providers (UiPath, Automation Anywhere) – Robust RPA, but IT - heavy and task - based. • No - Code Workflow Platforms – Easy to use, integration - rich, but lack advanced AI depth. • System Integrators & Consulting Firms – High - cost IT/digital transformation, slower deployment. • Industry - Specific Solutions – Niche players serving verticals (finance, insurance, etc.).

YOOV Differentiation Nasdaq: ALBT 11 x AI - Powered, No - Code Platform – Accessible to all businesses; rapid deployment & shorter timelines. x Comprehensive AIaaS Ecosystem – Modules like Operations AI, People AI, Sales AI; integrates with credit & insurance. x Smart Solutions with Scalability – Automates complex workflows; growing adoption in retail & financial sectors. x Affordability & Customization – Competitive pricing for SMEs; tailored to unique workflows. x Balanced Value Proposition – Combines enterprise - grade AI depth with no - code accessibility; positioned as a technology - forward partner.

YOOV Growth Strategy • Expanding Market Presence – AIaaS market forecasted CAGR of 36.8% (2025 – 2030); scaling offerings across finance, healthcare, retail, and manufacturing. • Global Expansion – Initial focus on Southeast Asia, followed by Australia, New Zealand, and Middle East to broaden geographic reach. • Product Innovation – Continuous R&D in AI and low - code/no - code platforms; Gartner projects 70% of new enterprise apps will be low - code by 2025. • Strategic Partnerships – Forge alliances with technology providers, system integrators, and cloud platforms to expand distribution. • Operational Efficiency – Demonstrate ROI of automation; McKinsey estimates 60% of occupations have ≥30% automatable activities. • Regulatory & Economic Trends – Address labor shortages, rising costs, and compliance challenges with AI - driven automation. • Mergers & Acquisitions – Pursue acquisitions to expand technology, enter new markets, and strengthen competitive positioning. Nasdaq: ALBT 12

Senior Management Team David Jin, M.D., Ph.D. CEO, President, Co - founder, BoD U.S. Licensed Physician; Former Medical Resident, Fellow and Faculty Member at Weill Cornell Medicine and New York - Presbyterian Hospital; Senior Clinician - Scientist at Ansary Stem Cell Institute; Former CMO of BioTime Inc. and OncoCyte Corporation Luisa Ingargiola, MHA CFO, Former CFO and BoD of several U.S. Public companies Meng Li COO, Former WPP’s Group Company Executive Nasdaq: ALBT 13 Avalon’s Management Team with Proven Ability to Deliver

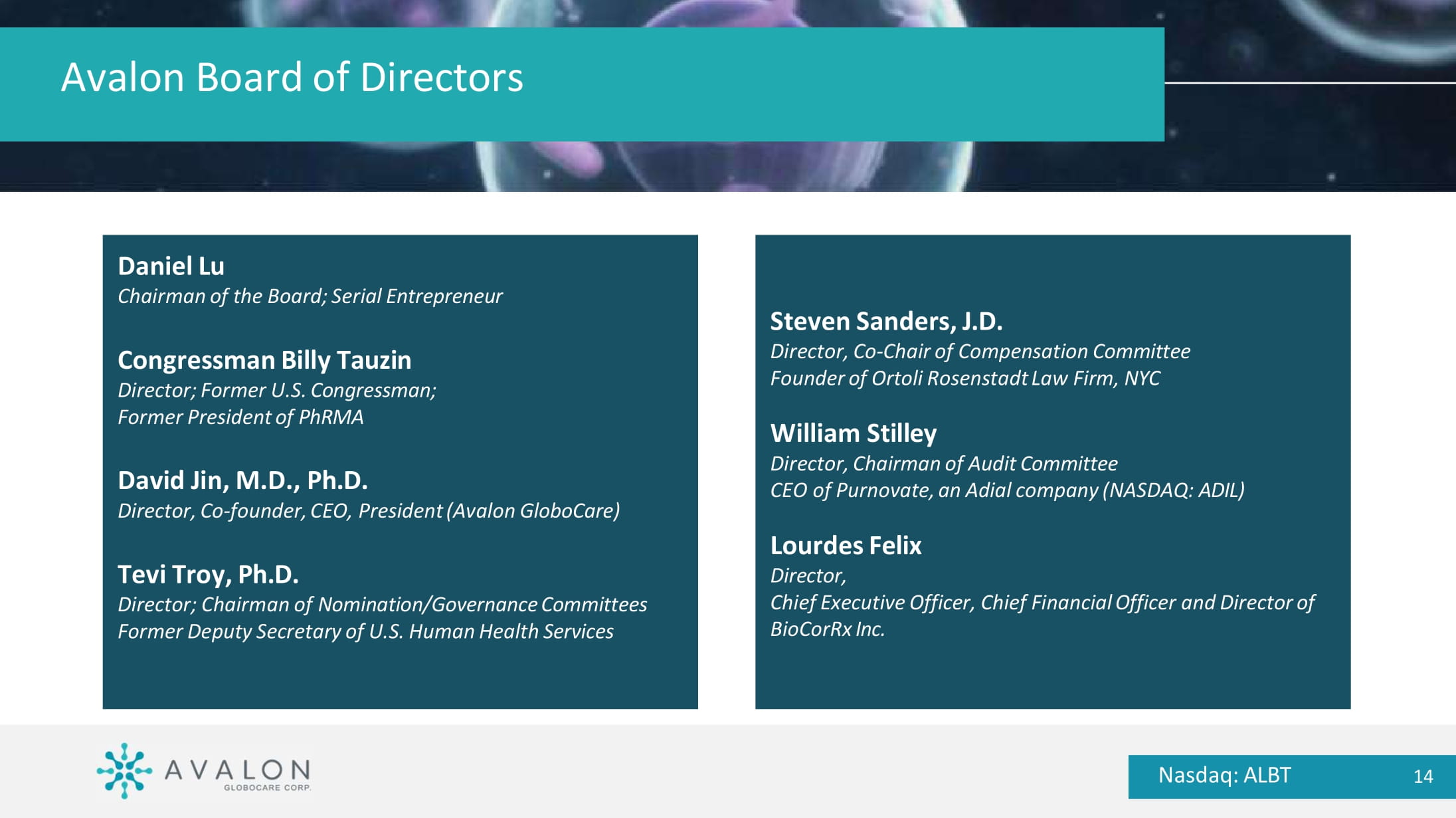

Avalon Board of Directors Nasdaq: ALBT 14 Steven Sanders, J.D. Director, Co - Chair of Compensation Committee Founder of Ortoli Rosenstadt Law Firm, NYC William Stilley Director, Chairman of Audit Committee CEO of Purnovate, an Adial company (NASDAQ: ADIL) Lourdes Felix Director, Chief Executive Officer, Chief Financial Officer and Director of BioCorRx Inc. Daniel Lu Chairman of the Board; Serial Entrepreneur Congressman Billy Tauzin Director; Former U.S. Congressman; Former President of PhRMA David Jin, M.D., Ph.D. Director, Co - founder, CEO, President (Avalon GloboCare) Tevi Troy, Ph.D. Director; Chairman of Nomination/Governance Committees Former Deputy Secretary of U.S. Human Health Services

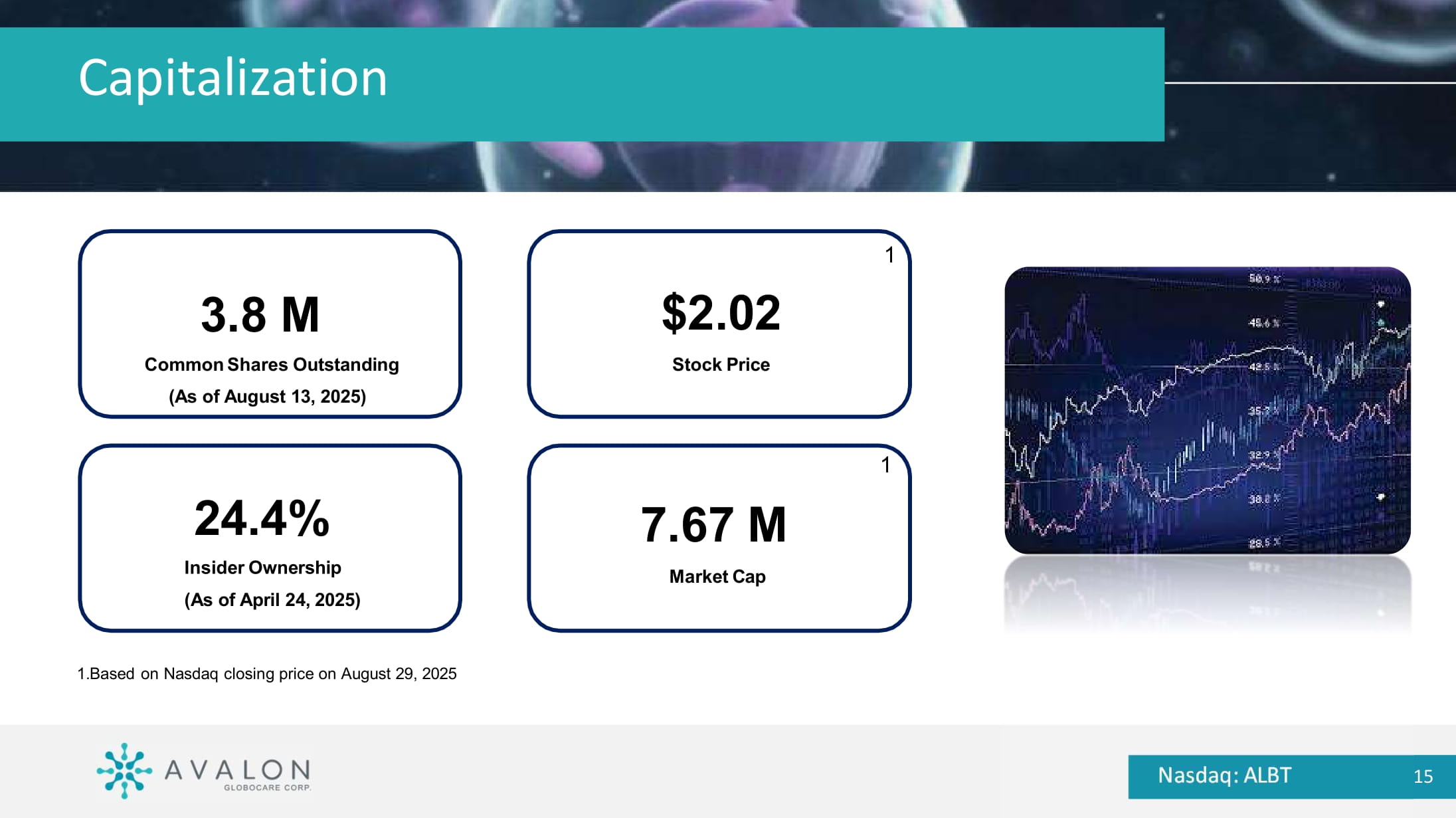

Capitalization 3 . 8 M Common Shares Outstanding (As of August 13, 2025) Nasdaq: ALBT 15 $ 2 . 02 Stock Price 24 . 4 % Insider Ownership (As of April 24, 2025) 7 . 67 M Market Cap 1 1 1.Based on Nasdaq closing price on August 29 , 202 5

www.avalon - globocare.com Nasdaq: ALBT Contact: Avalon Executive Center 4400 Route 9 South, Suite 3100 Freehold, New Jersey 07728, USA Website: www.avalon - globocare.com IR Email: albt@crescendo - ir.com Thank You