As filed with the Securities and Exchange Commission on July 20, 2018.

Registration No. 333-224343

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment

No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

AVALON

GLOBOCARE CORP.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

8742 (Primary Standard Industrial Classification Code Number) |

47-1685128 (IRS Employer Identification No.) |

4400

Route 9 South

Suite 3100

Freehold, New Jersey 07728

732-780-4400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

David

Jin

Chief Executive Officer

4400 Route 9 South

Suite 3100

Freehold, New Jersey 07728

732-780-4400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

| Thomas

S. Levato Goodwin Procter LLP The New York Times Building 620 Eighth Avenue New York, New York 10018 (212) 813-8800 |

Elizabeth

Fei Chen 7 Times Square New York, New York 10036 (212) 421-4100 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ☐ | Accelerated Filer ☐ | |||

| Non-accelerated Filer ☐ | (Do not check if a smaller reporting company) | Smaller Reporting Company ☒ | ||

| Emerging Growth Company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Calculation of Registration Fee

| Title of Each Class of Securities To Be Registered |

Proposed

Maximum Aggregate Offering Price (1) |

Amount of Registration Fee |

| Common Stock, $0.0001 par value per share | $5,000,000 | $623 |

| Underwriter Warrants (2) | — | — |

| Common Stock, $0.0001 par value per share, underlying Underwriter Warrants (3) | $350,000 | $44 |

| Total | $5,350,000 | $667(4) |

| (1) | The registration fee for securities is based on an estimate of the proposed maximum offering price of the securities, and such estimate is solely for the purpose of calculating the registration fee pursuant to Rule 457(o). |

| (2) | No separate fee is required pursuant to Rule 457(g) under the Securities Act of 1933. |

| (3) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act of 1933. If the Registrant completes this offering, then on the closing date, the Registrant will issue underwriter warrants to Boustead Securities, LLC to purchase such number of shares of common stock equal to seven percent (7.0%) of the total number of shares of common stock sold by the Registrant in the offering at an exercise price of 100% of the price at which the Registrant sells shares of common stock in this offering. | |

| (4) | Previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 20, 2018

PRELIMINARY PROSPECTUS

$5,000,000 of Shares of Common Stock

We are offering on a “best efforts” basis $5,000,000 of our shares of common stock, $0.0001 par value per share. We estimate that the public offering price will be $2.25 per share.

Our common stock currently is quoted on the OTCQB Marketplace, operated by OTC Markets Group, under the symbol “AVCO.” The last reported sale price of our common stock on the OTCQB Marketplace on July 19, 2018 was 2.80 per share. We have applied to list our common stock on the Nasdaq Capital Market and intend to apply to list our common stock on the NYSE American LLC. No assurance can be given that our application will be approved and we do not expect our common stock to be listed on either exchange upon completion of this offering.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and other filings with the Securities and Exchange Commission.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 14.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |

| Public offering price | $ | $ |

| Underwriting discount and commissions(1) | $ | $ |

| Proceeds, before expenses, to us | $ | $ |

(1) See “Underwriting” in this prospectus for more information regarding our arrangements with the underwriter.

The underwriter is selling our shares of common stock in this offering on a “best efforts” basis. The underwriter is not required to sell any specific number or dollar amount of shares of common stock but will use its best efforts to sell the shares of common stock offered.

Delivery of the shares of common stock is expected to be made on or about , 2018.

Sole Bookrunner

The date of this prospectus is , 2018.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or contained in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We have not, and the underwriter has not, authorized anyone to provide you with information that is different from that contained in such prospectuses. We are offering to sell shares of our common stock, and seeking offers to buy shares of our common stock, only in jurisdictions where such offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock.

Until and including , 2018 (25 days after the date of this prospectus), all dealers that buy, sell, or trade our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

For investors outside of the United States: neither we nor the underwriter have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

2

This summary highlights information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. You should read this entire prospectus and should consider, among other things, the matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and our consolidated financial statements and related notes thereto appearing elsewhere in this prospectus before making your investment decision.

Unless the context otherwise requires, any reference to "Avalon GloboCare," "Avalon," “the company,” “we,” “us,” or “our” refers to Avalon GloboCare Corp., a Delaware corporation, and its subsidiaries.

Overview

We are dedicated to integrating and managing global healthcare services and resources, as well as empowering high-impact biomedical innovations and technologies to accelerate their clinical applications. Operating through two major platforms, namely “Avalon Cell” and “Avalon Rehab”, our “Technology + Service” ecosystem covers the areas of regenerative medicine, cell-based immunotherapy, exosome technology, as well as rehabilitation medicine. We plan to integrate these services through joint ventures and accretive acquisitions that bring shareholder value both in the short term, through operational entities as part of Avalon Rehab, and long term, through biomedical innovation development as part of Avalon Cell, such as our recent joint venture for the advancement of exosome isolation systems and related products.

In addition, we are engaged in the development of exosome technology to improve the diagnosis and management of diseases. Exosomes are tiny, subcellular, membrane-bound vesicles 30-150 nm in diameter that are released by almost all cell types and can carry membrane and cellular proteins, as well as genetic materials that are representative of the cell of origin. Profiling various bio-molecules in exosomes may serve as useful biomarkers for a wide variety of diseases. Our isolation system is designed to be used by researchers for biomarker discovery and clinical diagnostic development, and advancement of targeted therapies. Currently, isolation systems and service are available to isolate exosomes or extract exosomal RNA/protein from serum/plasma, urine and saliva samples. We are seeking to decode proteomic and genomic alterations underlying a wide-range of pathologies, thus allowing for the introduction of novel non-invasive “liquid biopsies”. Our mission is focused on diagnostic advancements in the fields of oncology, infectious diseases and fibrotic diseases, and the discovery of disease-specific exosomes to provide the disease origin insight necessary to enable personalized clinical management. There is no guarantee that we will be able to successfully achieve our stated mission.

We currently generate revenue by selling exosome isolation systems in China and the United States through our joint venture GenExosome Technologies, Inc. In addition, we provide medical related consulting services in advanced areas of immunotherapy and second opinion/referral services through our wholly-owned subsidiary Avalon (Shanghai) Healthcare Technology Co., Ltd., or Avalon Shanghai. We also own and operate commercial real estate in New Jersey, where we are headquartered.

Sales and Marketing

We seek to develop new business through relationships driven by our senior management, which have extensive contacts throughout the healthcare system. Our senior management will be seeking opportunities for joint ventures, strategic relationships and acquisitions in consulting, biomedical innovations, telemedicine, and rehabilitation centers.

Services

We currently generate revenue from related party strategic relationships through Avalon Shanghai that provide consultative services in advanced areas of immunotherapy and second opinion/referral services. In addition, our services are targeted at serving our clients and using our insights and deep expertise to produce tangible and significant results. Our services include research studies, executive education, daily online executive briefings, tailored expert advisory services, and consulting and management services. We typically charge an annual fee. Through our services, we attempt to have our clients focus on important problems by providing an analysis of the evolving healthcare industry and the methods prevalent in the industry to solve those problems through counsel, business planning and support. We tailor these solutions to the client’s specific strategic challenges, operational issues, and management concerns. We plan to expand our business services throughout the United States via our two major “Technology + Service” platforms: “Avalon Cell” and “Avalon Rehab”.

3

Strategic Partnerships

We are actively seeking potential strategic partnerships in our area of focus. In addition, we are actively seeking target acquisitions that add accretive value to our strategic plan. There is no guarantee that we will be able to successfully sign a definitive agreement, close or implement such business arrangement. Through our recent joint venture in the area of exosome technology, we are actively developing strategic relationships for the distribution and sale of our exosome isolation system and for the commercialization of exosome related products and diagnostic services.

Markets

We will focus on the following markets in developing our core business:

Platform “Avalon Cell”

Regarded as the future of medicine, we believe cell-based therapeutics will replace pharmaceuticals as a more effective and functional modality in disease treatment. We are actively engaging in this revolutionary trend and positioning to take a leading role in cell-based technology and therapeutics. The business model for our “Avalon Cell” platform is based on stringent criteria in the selection and evaluation of candidate projects at different stages of their developmental cycle. We particularly focus on projects that have strong intellectual property and distinctive innovation, as well as being translational, application-driven, and commercialization-ready. Our technology-based platform, “Avalon Cell”, comprises four programs:

| ● | Exosome technology, small extracellular vesicles that have great potential to be used as a vehicle for drug delivery in the treatment of various diseases and biomarkers for early stage diagnosis. We have commenced developing collaborative sites at Weill Cornell Medical College, MD Anderson Cancer Center and Mayo Clinic in the United States, as well as Lu Daopei Hospital of Daopei Medical Group and Da An Gene Co, Ltd., in China, focusing on exosome-based diagnostics, therapeutics, bio-banking, as well as “Exosomics Big Data”, in the unmet areas of oral cancer, ovary cancer and liver fibrosis; |

| ● | Endothelial cells, namely therapeutics involving the cells that line blood vessels and regulate exchanges between the bloodstream and surrounding tissue. These programs will occur with our collaborative sites at Weill Cornell Medical College Department of Pathology and Ansary Stem Cell Institute, focusing on standardization of endothelial cell banking and therapeutics; |

| ● | Regenerative medicine; and |

| ● | Cell-based immunotherapy (including cells such as NK, DC-CIK, CAR-T). |

Platform “Avalon Rehab”

A growing trend in China is in the sector of rehabilitation medicine. With our strong capabilities in integrating global technology and resources in physical medicine and rehabilitation, we will work towards positioning ourselves to take a leading role in this area through our “Avalon Rehab” platform. Our goal with this platform is to provide a turnkey, full suite of rehab services including physical therapy, occupational therapy, robotic engineering, cybernetics, and clinical nutrition. We will also engage in strategic partnerships with our institutional clients, building the leading and most authoritative network of integrated physical medicine and rehabilitation, particularly for cancer rehab patients. We expect our initial flagship clinical bases for Avalon Rehab to include: Hebei Yanda Lu Daopei Hospital, Beijing Lu Daopei Hospital, and Beijing Daopei Hematology Hospital, with participating strategic partners MD Anderson Cancer Center and Kessler Rehabilitation Institute. The focus will be on accretive acquisitions and joint venture strategic partnerships that are in revenue generating, cash flow positive positions to support biomedical innovation development while providing immediate shareholder value.

4

Revenue

GenExosome Technologies, Inc.

Through our majority-owned subsidiary, GenExosome Technologies, Inc., or GenExosome, we market and sell our proprietary exosome isolation systems. Exosomes are small extracellular vesicles that we believe may be used as a vehicle for drug delivery in the treatment of various diseases, and biomarkers for early stage diagnosis and as enhancements to certain cosmetic treatments and procedures. We currently produce our isolation systems in China and the U.S., and sell these systems primarily to research laboratories and universities.

Further, we generate revenue by performing development services for hospitals and sales of related products developed to hospitals through GenExosome and Beijing Jieteng (GenExosome) Biotech Co., Ltd., or Beijing GenExosome, GenExosome’s wholly-owned subsidiary.

Avalon RT 9 Properties, LLC

In May 2017, we acquired commercial property located in Freehold, New Jersey. This property is now our corporate headquarters and contains several commercial tenants that allows us to generate revenue through rental income. The revenue generated from the commercial tenants in our Freehold, New Jersey headquarters is facilitated through a management agreement with a company, which is controlled by Wenzhao Lu, our major shareholder and Chairman of the Board of Directors, based in the United States.

Avalon Shanghai

We currently generate revenue by providing medical related consulting services in advanced areas of immunotherapy and second opinion/referral services through Avalon (Shanghai) Healthcare Technology Co., Ltd., or Avalon Shanghai. Our medical related consulting services include research studies, executive education, daily online executive briefings, tailored expert advisory services, and consulting and management services. We typically charge an annual fee. Through our services we attempt to have our clients focus on important problems by providing an analysis of the evolving healthcare industry and the methods prevalent in the industry to solve those problems through counsel, business planning and support. The revenue generated from our related parties in China is managed by our employees residing in China and contactors who are retained as needed. Our contracts with the Ludaopei Hematology Research Institute Co., Ltd, a subsidiary of the Daopei Hospital Group (a related party of ours), expired as of March 31, 2018. On April 1, 2018, Avalon Shanghai entered into an advisory service contract with Beijing Ludaopei Blood Disease Research Institute Co., Ltd., a subsidiary of the Daopei Hospital Group (a related party of ours). Under the terms of the contract, we will receive advisory service fees in the aggregate amount of $300,000, of which $150,000 was invoiced on June 30, 2018 and the remaining $150,000 will be invoiced on or before September 30, 2018. The contract expires on December 31, 2018. Consulting services to be provided by Avalon Shanghai under the contract include:

| ● | providing scientific research consulting services; |

| ● | integrating experts, medical institutions and other resources in the United States in support of scientific research; |

| ● | providing technical education and training; and |

| ● | assisting in publication of academic papers. |

5

Strategic Development

We intend to focus on three components. The initial component will be focused on acquiring and/or managing fixed assets including healthcare real estate as well as stem cell banks. In addition, we intend to pursue the acquisition and development of healthcare related technologies for cell related diagnostics and therapeutics through acquisition, licensing or joint ventures with major universities and biotech companies. We will also consider a third avenue of investing in certain technologies for cell related diagnostics and therapeutics.

Recent Developments

Private Placement

From April 2018 through May 2018, we entered into subscription agreements with four accredited investors pursuant to which these investors purchased an aggregate of 3,107,000 shares of the Company’s common stock for a purchase price of $5,437,250. The closing occurred with respect to $3,500,000 on April 20, 2018, with respect to $157,500 on April 26, 2018, with respect to $997,500 on May 5, 2018 and with respect to $782,250 on May 24, 2018. In connection with this private placement, we are required to pay Boustead Securities, LLC, acting as placement agent, a cash fee of equal to 7% of the gross proceeds received by us from such closing and issue to the placement agent warrants to purchase common stock exercisable for a period of five years equal to 7% of the gross proceeds received by us from such closing, divisible by and exercisable at a strike price equal to 100% of the fair market value of our common stock as of the date of the closing.

DOING Biomedical Technology Co., Ltd. Investment

On April 23, 2018, we, Avalon Shanghai, Beijing DOING Biomedical Technology Co., Ltd., or DOING, and the accredited investor party to a subscription agreement with us executed on March 3, 2017 for a purchase price of $3,000,000, or the DOING Investment, entered into a Supplementary Agreement Related to Share Subscription pursuant to which Avalon Shanghai agreed to pay approximately USD $1,305,000 to DOING representing one-third of the DOING Investment plus 20% interest resulting in a reduction in the shares from the March 2017 transaction by one-third to 2,000,000 shares. Further, the parties agreed that certain repayment obligations owed to DOING shall be extended to July 31, 2018 at which time DOING may require that we pay $2,000,000 plus 20% interest to DOING resulting in the cancellation of the remaining shares from the March 2017 transaction. However, DOING may, in its discretion, require that the remaining shares from the March 2017 transaction be transferred to a new nominal holder who shall pay the required subscription price, which funds will, in turn, be used to satisfy the such repayment obligations. For a further description of the March 2017 transaction, see “Certain Relationships and Related-Party Transactions - Warranty Agreement.”

Joint Venture - Airuikang Biological Technology Co., Ltd.

On May 29, 2018, Avalon Shanghai entered into a Joint Venture Agreement with Jiangsu Unicorn Biological Technology Co., Ltd., or Unicorn, pursuant to which the parties agreed to establish a company named Airuikang Biological Technology Co., Ltd., or ABT, which will be owned 60% by Unicorn and 40% by Avalon Shanghai. Within two years of execution of the Joint Venture Agreement, Unicorn shall invest cash into ABT in an amount not less than RMB 8,000,000 Yuan and the premises of the laboratories of Nanjing Hospital of Chinese Medicine for exclusive use by the ABT, and Avalon Shanghai shall invest cash into ABT in an amount not less than 10,000,000 Yuan. The board of directors of ABT shall consist of five members with Unicorn appointing three members and Avalon Shanghai appointing two members. ABT will be focused on cell preparation, third party testing, biological sample repository for commercial and scientific research purposes and the clinical transformation of scientific achievements.

6

Avactis Biosciences

On July 18, 2018, we formed a wholly owned subsidiary, Avactis Biosciences, Inc., which will be focused on accelerating commercial activities related to Chimeric Antigen Receptor (CAR)-T technologies. The new subsidiary is designed to integrate and optimize our global scientific and clinical resources to further advance the use of CAR-T to treat certain cancers.

Changes to Board of Directors

On June 4, 2018, Tevi Troy was appointed to the Board of Directors. Dr. Troy will receive options to acquire 40,000 shares of common stock per year commencing January 1, 2019 at an exercise price equal to the closing price on December 31st of the prior year. The options shall vest in equal amounts quarterly and shall be exercisable for a period of five years. For 2018, we granted Dr. Troy options to acquire 20,000 shares of common stock at an exercise price of $2.30 for a term of five years with 10,000 options vesting immediately and the balance vesting October 1, 2018. In addition, Dr. Troy will receive $5,000 per quarter for serving as chairman of the nominating and corporate governance committee commencing upon formation.

On July 5, 2018, William B. Stilley, III was appointed to the Board of Directors. Mr. Stilley will receive options to acquire 40,000 shares of common stock per year commencing January 1, 2019 at an exercise price equal to the closing price on December 31st of the prior year. The options shall vest in equal amounts quarterly and shall be exercisable for a period of five years. For 2018, we granted Mr. Stilley options to acquire 20,000 shares of common stock at an exercise price of $2.30 for a term of five years with 10,000 options vesting immediately and the balance vesting October 1, 2018. In addition, Mr. Stilley will receive $7,500 per quarter for serving as chairman of the audit committee commencing upon formation.

On July 9, 2018, Meng Li resigned as a director of the Company. Ms. Li will continue to serve as our Chief Operating Officer and Secretary and will also serve as an observer to the Board of Directors without voting capacity.

Risk Factors

An investment in our common stock involves a high degree of risk. You should consider and read carefully all of the risks and uncertainties described in “Risk Factors” beginning on page 14, together with all of the other information contained in this prospectus, including our consolidated financial statements and related notes thereto appearing elsewhere in this prospectus, before investing in our common stock. These risks could materially affect our business, financial condition and results of operations and cause the trading price of our common stock to decline. You could lose part or all of your investment. You should bear in mind, in reviewing this prospectus, that past experience is no indication of future performance. You should read “Cautionary Note Regarding Forward-Looking Statements” for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this prospectus.

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, and we are eligible to take advantage of certain exemptions from various reporting and financial disclosure requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, (1) presenting only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations in this prospectus, (2) not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, (3) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and (4) exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these exemptions. As a result, investors may find investing in our shares of common stock less attractive.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards. As a result, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We elected to opt out of such extended transition period and acknowledge such election is irrevocable pursuant to Section 107 of the JOBS Act.

7

We could remain an emerging growth company for up to five years, or until the earliest of (1) the last day of the first fiscal year in which our annual gross revenues exceed $1.07 billion, (2) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our shares of common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter and we have been publicly reporting for at least 12 months, or (3) the date on which we have issued more than $1.0 billion in non-convertible debt during the preceding three-year period.

Corporate Information

We were incorporated under the laws of the State of Delaware on July 28, 2014 under the name Global Technologies Corp. On October 18, 2016, we changed our name to Avalon GloboCare Corp. and completed a reverse split of our shares of common stock at a ratio of 1:4.

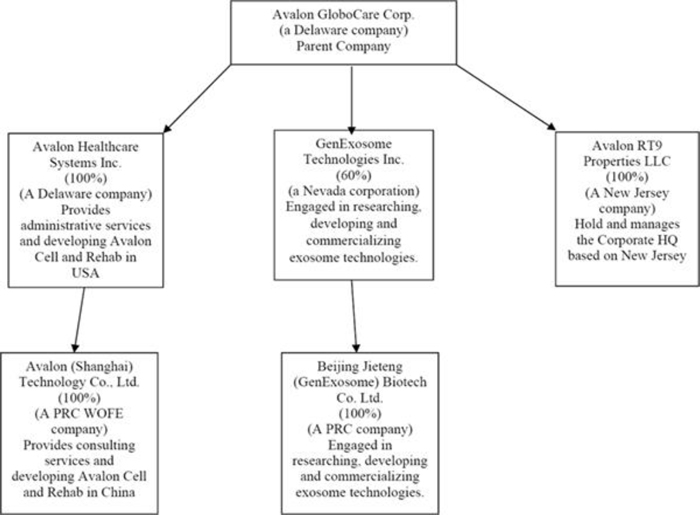

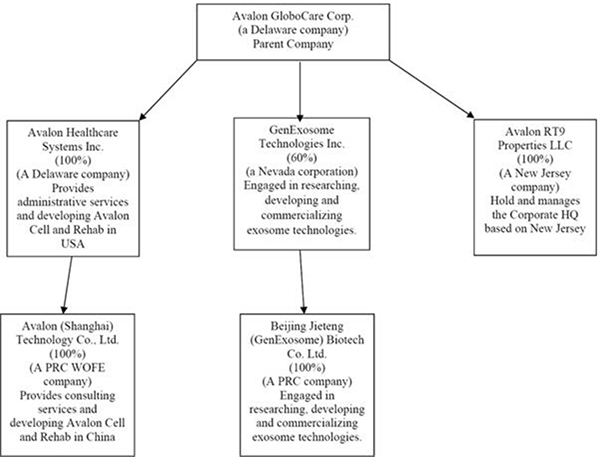

We own 100% of the capital stock of Avalon Healthcare Systems, Inc., a Delaware company, or AHS, which we acquired on October 19, 2016. AHS was incorporated on May 18, 2015 under the laws of the State of Delaware. In addition, we own through AHS 100% of the capital stock of Avalon (Shanghai) Healthcare Technology Co., Ltd., or Avalon Shanghai, which is a wholly foreign-owned enterprise, or WOFE, organized under the laws of the People’s Republic of China, or PRC or China. Avalon Shanghai was incorporated on April 29, 2016 and is engaged in medical related consulting services for customers. On February 7, 2017, we formed Avalon RT 9 Properties, LLC, a New Jersey limited liability company, and on January 23, 2017, we incorporated Avalon (BVI) Ltd, a British Virgin Islands company (dormant, to be dissolved in 2018). In July 2017, we formed GenExosome Technologies Inc., a Nevada corporation, or GenExosome. On October 25, 2017, we and GenExosome entered into a Securities Purchase Agreement pursuant to which we acquired 600 shares of GenExosome in consideration of $1,326,087 in cash and 500,000 shares of our common stock. On October 25, 2017, GenExosome entered into and closed an Asset Purchase Agreement with Yu Zhou, MD, PhD, pursuant to which we acquired all assets, including all intellectual property, held by Dr. Zhou pertaining to the business of researching, developing and commercializing exosome technologies in consideration of $876,087 in cash, 500,000 shares of our common stock and 400 shares of common stock of GenExosome. As a result of the above transactions, we hold 60% of GenExosome and Dr. Zhou holds 40% of GenExosome. On October 25, 2017, GenExosome entered into and closed a Stock Purchase Agreement with Beijing Jieteng (GenExosome) Biotech Co. Ltd., a corporation incorporated in the People’s Republic of China, Beijing GenExosome, and Dr. Zhou, the sole shareholder of Beijing GenExosome, pursuant to which GenExosome acquired all of the issued and outstanding securities of Beijing GenExosome in consideration of a cash payment in the amount of $450,000.

8

The following diagram illustrates our corporate structure as of the date of this prospectus:

The above diagram does not include our wholly-owned subsidiary, Avactis Biosciences, Inc., which was formed on July 18, 2018 and has no current operations.

Our principal executive offices are located at 4400 Route 9 South, Suite 3100, Freehold, New Jersey 07728. Our telephone number is (646) 762-4517. Our website address is www.avalon-globocare.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus.

9

The Offering

| Common stock offered by us | $5,000,000 of shares of common stock. |

Best efforts

|

The underwriter is selling our shares of common stock on a “best efforts” basis. Accordingly, the underwriter has no obligation or commitment to purchase any securities. The underwriter is not required to sell any specific number or dollar amount of common stock but will use its best efforts to sell the shares of common stock offered. |

10

Common

stock to be outstanding immediately |

shares of common stock. |

| Use of proceeds | We intend to use the net proceeds from this offering for the implementation of our business plan including mergers and acquisitions, debt repayment, laboratory and clinical trials, general and administrative expenses and working capital. See “Use of Proceeds.” |

| Trading Market | Our common stock currently is quoted on the OTCQB Marketplace under the symbol “AVCO.” We have applied to list our common stock on the Nasdaq Capital Market and intend to apply to list our common stock on the NYSE American LLC. However, we do not expect our common stock to be listed on the Nasdaq Capital Market or the NYSE American LLC upon completion of this offering. |

| Risk factors | You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

The number of shares of our common stock that will be outstanding immediately after this offering is based on 69,758,622 shares of common stock outstanding as of March 31, 2018. This calculation excludes 2,410,000 shares of common stock issuable upon exercise of stock options outstanding as of March 31, 2018.

On February 26, 2018, we received written consent in lieu of a meeting of stockholders from holders of shares of our common stock representing approximately 72.6% of the total issued and outstanding shares of our common stock and a unanimous written consent of our board to approve a resolution granting our board discretionary authority, for a period of 12 months, to effect a reverse stock split of our common stock at a ratio between 1-for-2 to 1-for-10, such ratio to be determined by our board. A reverse stock split has not been effected and the board may choose not to do so at its discretion. All share numbers and prices per share reflected in this prospectus do not reflect any proposed reverse stock split.

11

Summary Consolidated Financial Data

The following tables summarize our historical consolidated financial data. We have derived the historical consolidated statements of operations data for the years ended December 31, 2017 and 2016, from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the historical consolidated statements of operations data for the three months ended March 31, 2018 and 2017, and the historical consolidated balance sheet data as of March 31, 2018 from our unaudited consolidated financial statements included elsewhere in this prospectus. The following summary consolidated financial data should be read in conjunction with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future, and our results for any interim period are not necessarily indicative of the results to be expected for a full fiscal year.

Consolidated Statements of Operations Data:

| For the Three Months | For the Three Months | For the Year | For the Year | |||||||||||||

| Ended | Ended | Ended | Ended | |||||||||||||

| March 31, 2018 | March 31, 2017 | December 31, 2018 | December 31, 2017 | |||||||||||||

| Revenue | ||||||||||||||||

| Real property rental | $ | 296,623 | $ | - | $ | 828,663 | $ | - | ||||||||

| Medical related consulting services - related parties | - | 66,286 | 222,611 | 616,446 | ||||||||||||

| Development services and sales of developed products | 11,290 | - | 26,276 | - | ||||||||||||

| Total revenues | 307,913 | 66,286 | 1,077,550 | 616,446 | ||||||||||||

| Costs and expenses | ||||||||||||||||

| Real property operating expenses | 210,274 | - | 542,371 | - | ||||||||||||

| Medical related consulting services - related parties | - | 99,581 | 272,400 | 73,066 | ||||||||||||

| Development services and sales of developed products | 16,520 | - | 15,016 | - | ||||||||||||

| Total costs and expenses | 226,794 | 99,581 | 829,787 | 73,066 | ||||||||||||

| Real property operating income | 86,349 | - | 286,292 | - | ||||||||||||

| Gross (loss) profit from medical related consulting services | - | (33,295 | ) | (49,789 | ) | 543,380 | ||||||||||

| Gross (loss) profit from development services and sales of developed products | (5,230 | ) | - | 11,260 | - | |||||||||||

| Compensation and related benefits | 538,814 | 182,927 | 1,291,183 | 10,088 | ||||||||||||

| Professional fees | 571,772 | 207,218 | 1,033,308 | 395,780 | ||||||||||||

| Impairment loss | - | - | 1,321,338 | - | ||||||||||||

| Total other operating expenses | 1,395,838 | 459,588 | 4,125,626 | 466,447 | ||||||||||||

| Total other (expense) income, net | (236,250 | ) | (56,450 | ) | (171,782 | ) | 575 | |||||||||

| Income taxes | - | - | - | 21,927 | ||||||||||||

| Net (loss) income | $ | (1,550,969 | ) | $ | (549,333 | ) | $ | (4,049,645 | ) | $ | 55,581 | |||||

| Net (loss) income attributable to Avalon GloboCare Corp. common shareholders | (1,481,579 | ) | (549,333 | ) | (3,464,285 | ) | 55,581 | |||||||||

| Net (loss) income per common share attributable to Avalon GloboCare Corp. common shareholders - basic and diluted | $ | (0.02 | ) | $ | (0.01 | ) | $ | (0.05 | ) | $ | 0.00 | |||||

| Weighted average common shares outstanding - basic and diluted | 69,781,733 | 62,595,289 | 65,033,472 | 51,139,475 | ||||||||||||

12

Consolidated Balance Sheet Data:

| As of March 31, 2018 | ||||||||

| Actual | Pro Forma | |||||||

| Cash | $ | 2,125,656 | $ | 6,325,656 | ||||

| Total current assets | 2,283,206 | 6,483,206 | ||||||

| Working capital (deficit) | (3,484,882 | ) | 715,118 | |||||

| Total non-current assets | 9,299,448 | 9,299,448 | ||||||

| Total assets | 11,582,654 | 15,782,654 | ||||||

| Total current liabilities | 5,768,088 | 5,768,088 | ||||||

| Total liabilities | 5,768,088 | 5,768,088 | ||||||

| Total Avalon GloboCare Corp. stockholders' equity | 6,469,190 | 10,669,190 | ||||||

| Non-controlling interest | (654,624 | ) | (654,624 | ) | ||||

| Total equity | 5,814,566 | 10,014,566 | ||||||

| Total liabilities and equity | $ | 11,582,654 | $ | 15,782,654 | ||||

The Pro Forma column in the consolidated balance sheet data table above reflects the receipt of approximately $4,200,000 in net proceeds from our sale of 2,222,222 shares of common stock in this offering at an assumed public offering price of $2.25 per share, after deducting estimated underwriting commissions (7.0%) and estimated offering expenses payable by us.

13

You should carefully consider the following material risk factors as well as all other information set forth or referred to in this prospectus before purchasing shares of our common stock. Investing in our common stock involves a high degree of risk. We believe all material risk factors have been presented below. If any of the following events or outcomes actually occurs, our business operating results and financial condition would likely suffer. As a result, the trading price of our common stock could decline, and you may lose all or part of the money you paid to purchase our common stock.

General Operating and Business Risks

Our limited operating history makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance.

We did not begin operations of our business through AHS until May 2015. We have a limited operating history and limited revenue. As a consequence, it is difficult, if not impossible, to forecast our future results based upon our historical data. Reliance on the historical results may not be representative of the results we will achieve, particularly in our combined form. Because of the uncertainties related to our lack of historical operations, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in revenues or expenses. If we make poor budgetary decisions as a result of unreliable historical data, we could be less profitable or incur losses, which may result in a decline in our stock price.

Our results of operations have not resulted in profitability and we may not be able to achieve profitability going forward.

We incurred a net loss amounting to $4,049,645 for the year ended December 31, 2017 and a net loss amounting to $1,550,969 for the three months ended March 31, 2018. If we incur additional significant losses, our stock price may decline, perhaps significantly. Our management is developing plans to achieve profitability. Our business plan is speculative and unproven. There is no assurance that we will be successful in executing our business plan or that even if we successfully implement our business plan, that we will be able to curtail our losses now or in the future. Further, as we are a new enterprise, we expect that net losses will continue and our working capital deficit will increase.

We depend upon key personnel and need additional personnel.

Our success depends on the continuing services of Wenzhao Lu, our Chairman of the Board, and David Jin, Meng Li and Luisa Ingargiola, our executive officers. The loss of Mr. Lu, Dr. Jin, Ms. Li or Ms. Ingargiola could have a material and adverse effect on our business operations. Additionally, the success of our operations will largely depend upon our ability to successfully attract and maintain competent and qualified key management personnel. As with any company with limited resources, there can be no guaranty that we will be able to attract such individuals or that the presence of such individuals will necessarily translate into profitability for us. Our inability to attract and retain key personnel may materially and adversely affect our business operations.

Currently, we have a single consulting contract with a related party in China. The loss of such customer could adversely impact our financial condition and results of operations.

During the year ended December 31, 2017, we recognized an aggregate of $1,077,550 in revenue, of which $222,611 was generated from related parties. During the three months ended March 31, 2018, we recognized an aggregate of $307,913 in revenue, of which $0 was generated from related parties. Wenzhao Lu, our Chairman and significant shareholder, is the Chairman of each of the related parties. Although we maintain close working relationships with our related parties, the consulting agreements with our related parties expired as of March 31, 2018. On April 1, 2018, Avalon Shanghai entered into an advisory service contract with Beijing Ludaopei Blood Disease Research Institute Co., Ltd., a subsidiary of the Daopei Hospital Group (a related party of ours). Under the terms of the contract, we will receive advisory service fees in the aggregate amount of $300,000, of which $150,000 was invoiced on June 30, 2018 and the remaining $150,000 will be invoiced on or before September 30, 2018. The contract expires on December 31, 2018. The loss of this related party customer, and our failure to replace such customer with other customers, could have a material adverse effect on our financial condition or results of operation.

14

Our auditors have issued a “going concern” audit opinion.

Our independent auditors have indicated, in their report on our December 31, 2017 consolidated financial statements, that there is substantial doubt about our ability to continue as a going concern. We had an accumulated deficit of $4,999,233 at March 31, 2018. We have a limited operating history and our continued growth is dependent upon the continuation of providing medical consulting services to our related parties, generating rental revenue from our income-producing real estate property in New Jersey and generating revenue from proprietary exosome isolation systems by developing proprietary diagnostic and therapeutic products leveraging exosome technology; hence generating revenues, and obtaining additional financing to fund future obligations and pay liabilities arising from normal business operations. In addition, the current cash balance cannot be projected to cover the operating expenses for the next twelve months from the date of this prospectus. These matters raise substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent on our ability to raise additional capital, implement our business plan, and generate significant revenues. There are no assurances that we will be successful in our efforts to generate significant revenues, maintain sufficient cash balance or report profitable operations or to continue as a going concern. We plan on raising capital through the sale of equity or debt instruments to implement our business plan. However, there is no assurance these plans will be realized and that any additional financings will be available to our company on satisfactory terms and conditions, if any.

We must effectively manage the growth of our operations, or our company will suffer.

To manage our growth, we believe we must continue to implement and improve our services and products. We may not have adequately evaluated the costs and risks associated with our planned expansion, and our systems, procedures, and controls may not be adequate to support our operations. In addition, our management may not be able to achieve the rapid execution necessary to successfully offer our products and services and implement our business plan on a profitable basis. The success of our future operating activities will also depend upon our ability to expand our support system to meet the demands of our growing business. Any failure by our management to effectively anticipate, implement, and manage changes required to sustain our growth would have a material adverse effect on our business, financial condition, and results of operations.

Our business requires substantial capital, and if we are unable to maintain adequate financing sources our profitability and financial condition will suffer and jeopardize our ability to continue operations.

In connection with the strategic development portion of our business, we will need significant capital in order to implement acquisitions of technologies. In addition, we will need a significant amount of capital in order to fully implement our advisory business, maintain our rental property and further develop our exosome business. If we are unable to maintain adequate financing or other sources of capital are not available, we could be forced to suspend, curtail or reduce our operations, which could harm our revenues, profitability, financial condition and business prospects.

Our revenue and results of operations may suffer if we are unable to attract new clients, continue to engage existing clients, or sell additional products and services.

We presently derive our revenue from providing medical related consulting services to a related party, generating rental revenue from our income-producing real estate property in New Jersey and generating revenue from proprietary exosome isolation systems by developing proprietary diagnostic and therapeutic products leveraging exosome technology. Our growth therefore depends on our ability to attract new clients, maintain existing clients and properties and sell additional products and services to existing clients. This depends on our ability to understand and anticipate market and pricing trends and our clients’ needs and our ability to deliver consistent, reliable, high-quality services. Our failure to engage new clients, continue to re-engage with our existing clients or cross-sell additional services could materially and adversely affect our operating results.

15

Our prospects will suffer if we are not able to hire, train, motivate, manage, and retain a significant number of highly skilled employees.

We only recently commenced business and we presently generate medical related consulting services to related parties, generating rental revenue from our income-producing real estate property in New Jersey and generating revenue from proprietary exosome isolation systems by developing proprietary diagnostic and therapeutic products leveraging exosome technology. On the consulting side, Wenzhao Lu, our Chairman and significant shareholder, is the Chairman of each of the clients in which we have provided consulting services. Our future success depends upon our ability to hire, train, motivate, manage, and retain a significant number of highly skilled employees, particularly research analysts, technical experts, and sales and marketing staff. We will experience competition for professional personnel in each of our business lines. Hiring, training, motivating, managing, and retaining employees with the skills we need is time consuming and expensive. Any failure by us to address our staffing needs in an effective manner could hinder our ability to continue to provide high-quality products and services and to grow our business.

Potential liability claims may adversely affect our business.

Our services, which may include recommendations and advice to organizations regarding complex business and operational processes and regulatory and compliance issues may give rise to liability claims by our clients or by third parties who bring claims against our clients. Healthcare organizations often are the subject of regulatory scrutiny and litigation, and we also may become the subject of such litigation based on our advice and services. Any such litigation, whether or not resulting in a judgment against us, may adversely affect our reputation and could have a material adverse effect on our financial condition and results of operations. We may not have adequate insurance coverage for claims against us.

In accordance with our strategic development policy, we may invest in companies for strategic reasons and may not realize a return on our investments.

Similar to the development of our majority-owned subsidiary, GenExosome, from time to time, we may make investments in companies. These investments may be for strategic objectives to support our key business initiatives but may also be standalone investments or acquisitions. Such investments or acquisitions could include equity or debt instruments in private companies, many of which may not be marketable at the time of our initial investment. These companies may range from early-stage companies that are often still defining their strategic direction to more mature companies with established revenue streams and business models. The success of these companies may depend on product development, market acceptance, operational efficiency, and other key business factors. The companies in which we invest may fail because they may not be able to secure additional funding, obtain favorable investment terms for future financings, or take advantage of liquidity events such as public offerings, mergers, and private sales. If any of these private companies fails, we could lose all or part of our investment in that company. If we determine that impairment indicators exist and that there are other-than-temporary declines in the fair value of the investments, we may be required to write down the investments to their fair value and recognize the related write-down as an investment loss.

Our growing operations in the PRC could expose us to risks that could have an adverse effect on our costs of operations.

Our client base is presently located in the PRC. We intend to grow this client base in the PRC as well as the United States. As a result, we expect to continue to add personnel in the PRC. With a significant focus of our operations in the PRC, our reliance on a workforce in the PRC exposes us to disruptions in the business, political, and economic environment in that region. Maintenance of a stable political environment between the PRC and the United States is important to our operations, and any disruption in this relationship may directly negatively affect our operations. Our operations in the PRC require us to comply with complex local laws and regulatory requirements and expose us to foreign currency exchange rate risk. Our operations may also be subject to reduced or inadequate protection of our intellectual property rights, and security breaches. Further, it may be difficult to transfer funds from our Chinese operations to our company. Negative developments in any of these areas could increase our costs of operations or otherwise harm our business.

16

We face intense competition which could cause us to lose market share.

In the healthcare markets in the United States and the People’s Republic of China, we will compete with large healthcare providers who have more significant financial resources, established market positions, long-standing relationships, and who have more significant name recognition, technical, marketing, sales, distribution, financial and other resources than we do. The resources available to our competitors to develop new services and products and introduce them into the marketplace exceed the resources currently available to us. This intense competitive environment may require us to make changes in our services, products, pricing, licensing, distribution, or marketing to develop a market position.

Our success is heavily dependent on protecting our intellectual property rights.

Through GenExosome, we own four patents in China with related trademarks. We are in the process of applying for those same patents and trademarks in the United States and are also in the process of developing additional patents and related intellectual property. We own and control a variety of trade secrets, confidential information, trademarks, trade names, copyrights, and other intellectual property rights that, in the aggregate, are of material importance to our business. We consider our trademarks, service marks, and other intellectual property to be proprietary, and rely on a combination of copyright, trademark, trade secret, non-disclosure, and contractual safeguards to protect our intellectual property rights. Our success will, in part, depend on our ability to obtain trademarks and patents. We have also entered into confidentiality agreements with our employees and consultants. We cannot be certain that others will not gain access to these trade secrets or that our patents will provide adequate protection. Others may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets.

We may face uncertainty and difficulty in obtaining and enforcing our patents and other proprietary rights.

Our success will depend in large part on our ability to obtain, maintain, and defend patents on our product candidates, obtain licenses to use third-party technologies, protect our trade secrets and operate without infringing the proprietary rights of others. There can be no assurance that our pending patent applications will be approved, or that challenges will not be instituted against the validity or enforceability of any patent licensed-in or owned by us. Additionally, we have entered into various confidentiality agreements with employees and third parties. There is no assurance that such agreements will be honored by such parties or enforced in whole or part by the courts. The cost of litigation to uphold the validity and prevent infringement of a patent is substantial. Furthermore, there can be no assurance that others will not independently develop substantially equivalent technologies not covered by patents to which we have rights or obtain access to our know-how. In addition, the laws of certain countries may not adequately protect our intellectual property. Our competitors may possess or obtain patents on products or processes that are necessary or useful to the development, use, or manufacture of our product candidates. There can also be no assurance that our proposed technology will not infringe upon patents or proprietary rights owned by others, with the result that others may bring infringement claims against us and require us to license such proprietary rights, which may not be available on commercially reasonable terms, if at all. Any such litigation, if instituted, could have a material adverse effect, potentially including monetary penalties, diversion of management resources, and injunction against continued manufacture, use, or sale of certain products or processes.

We also rely upon non-patented proprietary know-how. There can be no assurance that we can adequately protect our rights in such non-patented proprietary know-how, or that others will not independently develop substantially equivalent proprietary information or techniques or gain access to our proprietary know-how. Any of the foregoing events could have a material adverse effect on us. In addition, if any of our trade secrets, know-how or other proprietary information were to be disclosed, or misappropriated, the value of our trade secrets, know-how and other proprietary rights would be significantly impaired and our business and competitive position would suffer.

In September 2011, the Leahy-Smith America Invents Act, or the Leahy-Smith Act, was signed into law. The Leahy-Smith Act includes a number of significant changes to U.S. patent law. These include provisions that affect the way patent applications will be prosecuted and may also affect patent litigation. In particular, under the Leahy-Smith Act, the United States transitioned in March 2013 to a “first to file” system in which the first inventor to file a patent application will be entitled to the patent. Third parties are allowed to submit prior art before the issuance of a patent by the U.S. Patent and Trademark Office, or USPTO, and may become involved in opposition, derivation, post-grant and inter partes review, or interference proceedings challenging our patent rights. An adverse determination in any such submission, proceeding or litigation could reduce the scope of, or invalidate, our patent rights, which could adversely affect our competitive position.

17

The USPTO has developed new and untested regulations and procedures to govern the full implementation of the Leahy-Smith Act, and many of the substantive changes to patent law associated with the Leahy-Smith Act, and in particular, the “first-to-file” provisions, only became effective in March 2013. The Leahy-Smith Act has also introduced procedures that may make it easier for third parties to challenge issued patents, as well as to intervene in the prosecution of patent applications. Finally, the Leahy-Smith Act contains new statutory provisions that still require the USPTO to issue new regulations for their implementation, and it may take the courts years to interpret the provisions of the new statute. Accordingly, it is not clear what, if any, impact the Leahy-Smith Act will have on the operation of our business. The Leahy-Smith Act and its implementation could increase the uncertainties and costs surrounding the prosecution of our patent applications and the enforcement or defense of our issued patents.

It is difficult and costly to protect our proprietary rights, and we may not be able to ensure their protection. If we fail to protect or enforce our intellectual property rights adequately or secure rights to patents of others, the value of our intellectual property rights would diminish.

Our commercial viability will depend in part on obtaining and maintaining patent protection and trade secret protection of our product candidates, and the methods used to manufacture them, as well as successfully defending these patents against third-party challenges. Our ability to stop third parties from making, using, selling, offering to sell, or importing our products is dependent upon the extent to which we have rights under valid and enforceable patents or trade secrets that cover these activities.

The patent positions of pharmaceutical and biopharmaceutical companies can be highly uncertain and involve complex legal and factual questions for which important legal principles remain unresolved. No consistent policy regarding the breadth of claims allowed in biopharmaceutical patents has emerged to date in the United States. The biopharmaceutical patent situation outside the United States is even more uncertain. Changes in either the patent laws or in interpretations of patent laws in the United States and other countries may diminish the value of our intellectual property. Accordingly, we cannot predict the breadth of claims that may be allowed or enforced in the patents we own. Further, if any of our patents are deemed invalid and unenforceable, it could impact our ability to commercialize or license our technology.

The degree of future protection for our proprietary rights is uncertain because legal means afford only limited protection and may not adequately protect our rights or permit us to gain or keep our competitive advantage. For example:

| ● | others may be able to make products that are similar to our product candidates but that are not covered by the claims of any of our patents; |

| ● | we might not have been the first to make the inventions covered by any issued patents or patent applications we may have; |

| ● | we might not have been the first to file patent applications for these inventions; |

| ● | it is possible that any pending patent applications we may have will not result in issued patents; |

| ● | any issued patents may not provide us with any competitive advantages, or may be held invalid or unenforceable as a result of legal challenges by third parties; |

| ● | we may not develop additional proprietary technologies that are patentable or protectable under trade secrets law; or |

| ● | the patents of others may have an adverse effect on our business. |

We also may rely on trade secrets to protect our technology, especially where we do not believe patent protection is appropriate or obtainable. However, trade secrets are difficult to protect. Although we use reasonable efforts to protect our trade secrets, our employees, consultants, contractors, outside scientific collaborators, and other advisors may unintentionally or willfully disclose our information to competitors. In addition, courts outside the United States are sometimes less willing to protect trade secrets. Moreover, our competitors may independently develop equivalent knowledge, methods, and know-how.

18

If any of our trade secrets, know-how or other proprietary information is disclosed, the value of our trade secrets, know-how and other proprietary rights would be significantly impaired and our business and competitive position would suffer.

Our viability also depends upon the skills, knowledge and experience of our scientific and technical personnel, and our consultants and advisors. To help protect our proprietary know-how and our inventions for which patents may be unobtainable or difficult to obtain, we rely on trade secret protection and confidentiality agreements. To this end, we require all of our employees, consultants, advisors and contractors to enter into agreements which prohibit unauthorized disclosure and use of confidential information and, where applicable, require disclosure and assignment to us of the ideas, developments, discoveries and inventions important to our business. These agreements are often limited in duration and may not provide adequate protection for our trade secrets, know-how or other proprietary information in the event of any unauthorized use or disclosure or the lawful development by others of such information. In addition, enforcing a claim that a third party illegally obtained and is using any of our trade secrets is expensive and time consuming, and the outcome is unpredictable. If any of our trade secrets, know-how or other proprietary information is improperly disclosed, the value of our trade secrets, know-how and other proprietary rights would be significantly impaired and our business and competitive position would suffer.

We may incur substantial costs as a result of litigation or other proceedings relating to patent and other intellectual property rights and we may be unable to protect our rights to, or use of, our technology.

If we choose to go to court to stop a third party from using the inventions claimed in our patents, that individual or company has the right to ask the court to rule that such patents are invalid and/or should not be enforced against that third party. These lawsuits are expensive and would consume time and other resources, even if we were successful in discontinuing the infringement of our patents. In addition, there is a risk that the court will decide that these patents are not valid and that we do not have the right to stop the other party from using the inventions. There is also the risk that, even if the validity of these patents is upheld, the court will refuse to stop the other party on the ground that such other party’s activities do not infringe our rights to these patents. In addition, the U.S. Supreme Court has in the past invalidated tests used by the USPTO in granting patents over the past 20 years. As a consequence, issued patents may be found to contain invalid claims according to the newly revised standards. Some of our own patents may be subject to challenge and subsequent invalidation in a variety of post-grant proceedings, particularly inter partes review, before the USPTO or during litigation under the revised criteria, which make it more difficult to defend the validity of claims in already issued patents.

Furthermore, a third party may claim that we or our manufacturing or commercialization partners are using inventions covered by the third party’s patent rights and may go to court to stop us from engaging in our normal operations and activities, including making or selling our product candidates. These lawsuits are costly and could affect our results of operations and divert the attention of managerial and technical personnel. There is a risk that a court could decide that we or our commercialization partners are infringing the third party’s patents and order us or our partners to stop the activities covered by the patents. In addition, there is a risk that a court could order us or our partners to pay the other party damages for having violated the other party’s patents. The biotechnology industry has produced a proliferation of patents, and it is not always clear to industry participants, including us, which patents cover various types of products, manufacturing processes or methods of use. The coverage of patents is subject to interpretation by the courts, and the interpretation is not always uniform. If we are sued for patent infringement, we would need to demonstrate that our products, manufacturing processes or methods of use either do not infringe the patent claims of the relevant patent and/or that the patent claims are invalid, and we may not be able to do this. Proving invalidity, in particular, is difficult since it requires a showing of clear and convincing evidence to overcome the presumption of validity enjoyed by issued patents.

As some patent applications in the United States may be maintained in secrecy until the patents are issued, because patent applications in the United States and many foreign jurisdictions are typically not published until eighteen months after filing, and because publications in the scientific literature often lag behind actual discoveries, we cannot be certain that others have not filed patent applications for technology covered by our issued patents or our pending applications, or that we were the first to invent the technology. Our competitors may have filed, and may in the future file, patent applications covering technology similar to ours. Any such patent applications may have priority over our patent applications or patents, which could further require us to obtain rights to issued patents covering such technologies. If another party has filed a United States patent application on inventions similar to ours, we may have to participate in an interference proceeding declared by the USPTO to determine priority of invention in the United States. The costs of these proceedings could be substantial, and it is possible that such efforts would be unsuccessful if, unbeknownst to us, the other party had independently arrived at the same or similar invention prior to our own invention, resulting in a loss of our U.S. patent position with respect to such inventions.

Some of our competitors may be able to sustain the costs of complex patent litigation more effectively than we can because they have substantially greater resources. In addition, any uncertainties resulting from the initiation and continuation of any litigation or inter partes review proceedings could have a material adverse effect on our ability to raise the funds necessary to continue our operations.

19

Some jurisdictions in which we operate have enacted legislation which allows members of the public to access information under statutes similar to the U.S. Freedom of Information Act. Even though we believe our information would be excluded from the scope of such statutes, there are no assurances that we can protect our confidential information from being disclosed under the provisions of such laws. If any confidential or proprietary information is released to the public, such disclosures may negatively impact our ability to protect our intellectual property rights.

Breaches or compromises of our information security systems or our information technology systems or infrastructure could result in exposure of private information, disruption of our business and damage to our reputation, which could harm our business, results of operation and financial condition.

We utilize information security and information technology systems and websites that allow for the secure storage and transmission of proprietary or private information regarding our clients, patients, employees, vendors and others, including individually identifiable health information. A security breach of our network, hosted service providers, or vendor systems, may expose us to a risk of loss or misuse of this information, litigation and potential liability. Hackers and data thieves are increasingly sophisticated and operate large-scale and complex automated attacks, including on companies within the healthcare industry. Although we believe that we take appropriate measures to safeguard sensitive information within our possession, we may not have the resources or technical sophistication to anticipate or prevent rapidly-evolving types of cyber-attacks targeted at us, our clients, our patients, or others who have entrusted us with information. Actual or anticipated attacks may cause us to incur costs, including costs to deploy additional personnel and protection technologies, train employees, and engage third-party experts and consultants. We invest in industry standard security technology to protect personal information. Advances in computer capabilities, new technological discoveries, or other developments may result in the technology used by us to protect personal information or other data being breached or compromised. To our knowledge, we have not experienced any material breach of our cybersecurity systems. If our or our third-party service provider systems fail to operate effectively or are damaged, destroyed, or shut down, or there are problems with transitioning to upgraded or replacement systems, or there are security breaches in these systems, any of the aforementioned could occur as a result of natural disasters, software or equipment failures, telecommunications failures, loss or theft of equipment, acts of terrorism, circumvention of security systems, or other cyber-attacks, we could experience delays or decreases in revenue, and reduced efficiency of our operations. Additionally, any of these events could lead to violations of privacy laws, loss of customers, or loss, misappropriation or corruption of confidential information, trade secrets or data, which could expose us to potential litigation, regulatory actions, sanctions or other statutory penalties, any or all of which could adversely affect our business, and cause us to incur significant losses and remediation costs.

We may be exposed to liabilities under the Foreign Corrupt Practices Act, and any determination that we violated the Foreign Corrupt Practices Act or Chinese anti-corruption law could have a material adverse effect on our business.

We are subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. Chinese anti-corruption law also strictly prohibits bribery of government officials. We have operations, agreements with third parties and make sales in China, where corruption may occur. Our activities in China create the risk of unauthorized payments or offers of payments by one of the employees, consultants, sales agents or distributors of our company, even though these parties are not always subject to our control. It is our policy to implement safeguards to prevent these practices by our employees. However, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants, sales agents or distributors of our company may engage in conduct for which we might be held responsible.

Violations of the FCPA or other anti-corruption laws may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the United States government may seek to hold our company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

20

Risk Factors Related to Clinical and Commercialization Activity

Our product candidates will require substantial time and resources in order to be developed, and there is no guarantee that we will develop them successfully.

Our exosome isolation system is in the early stage of production and use. The therapeutic products that we plan to develop as a byproduct of our isolation system will require substantial additional research and development time and expense, and certain products may require extensive clinical trials and perhaps additional pre-clinical testing, prior to commercialization, which may never occur. There can be no assurance that product candidates will be developed successfully, perform in the manner anticipated, or be commercially viable.

We may not be able to file INDs to commence additional clinical trials on the timelines we expect, and even if we are able to do so, the FDA may not permit us to proceed.

We hope to file a number of investigational new drug applications, or INDs, for cell based therapies and diagnostic systems through INDs over the next several years. However, the timing of our filing of these INDs is primarily dependent on receiving further data from our pre-clinical studies, and our timing of filing on all product candidates is subject to further research. Additionally, our submission of INDs is contingent upon having sufficient financial resources to prepare and complete the application.

We cannot be sure that submission of an IND will result in the United States Food and Drug Administration, or FDA, allowing further clinical trials to begin, or that, once begun, issues will not arise that result in the suspension or termination of such clinical trials. Any IND we submit could be denied by the FDA or the FDA could place any future investigation of ours on clinical hold until we provide additional information, either before or after clinical trials are initiated. Additionally, even if such regulatory authorities agree with the design and implementation of the clinical trials set forth in an IND or clinical trial application, we cannot guarantee that such regulatory authorities will not change their requirements in the future. Unfavorable future trial results or other factors, such as insufficient capital to continue development of a product candidate or program, could also cause us to voluntarily withdraw an effective IND.

We have limited experience in conducting clinical trials.